Appointment booking system

Bank of Valletta's self-service appointment booking system streamlines the process, enabling hassle-free and time-saving appointment scheduling and management with just a few clicks.

Client

Team

Contribution

Duration

Year

Appointment booking system

Bank of Valletta's self-service appointment booking system streamlines the process, enabling hassle-free and time-saving appointment scheduling and management with just a few clicks.

Client

Team

Contribution

Duration

Year

Appointment booking system

Bank of Valletta's self-service appointment booking system streamlines the process, enabling hassle-free and time-saving appointment scheduling and management with just a few clicks.

Client

Team

Contribution

Duration

Year

We were approached by Bank of Valletta, the largest bank in Malta, to create a new and improved appointment booking solution as their current one was outdated and incomplete.

The problem

Bank of Valletta receives 100-150 booking requests daily. However, the current system is inefficient, labor-intensive, and prone to human errors. Moreover, the few customers who use the existing system express dissatisfaction with it.

The goal

Develop end-to-end streamlined the booking process to reduce bank employee's workload connected booking by at least 50%

Introduce automation to reduce internal labor, manual tasks, and possible human errors. (back-end)

Reduce bank customers' inconvenience, such as making phone calls or visiting a branch to modify appointments

Build a system that assists customers in finding bank branches that offer the specific banking services they need

Discovery & Definition

Understanding the industry, process, and the difficulties faced by both BoV and its customers

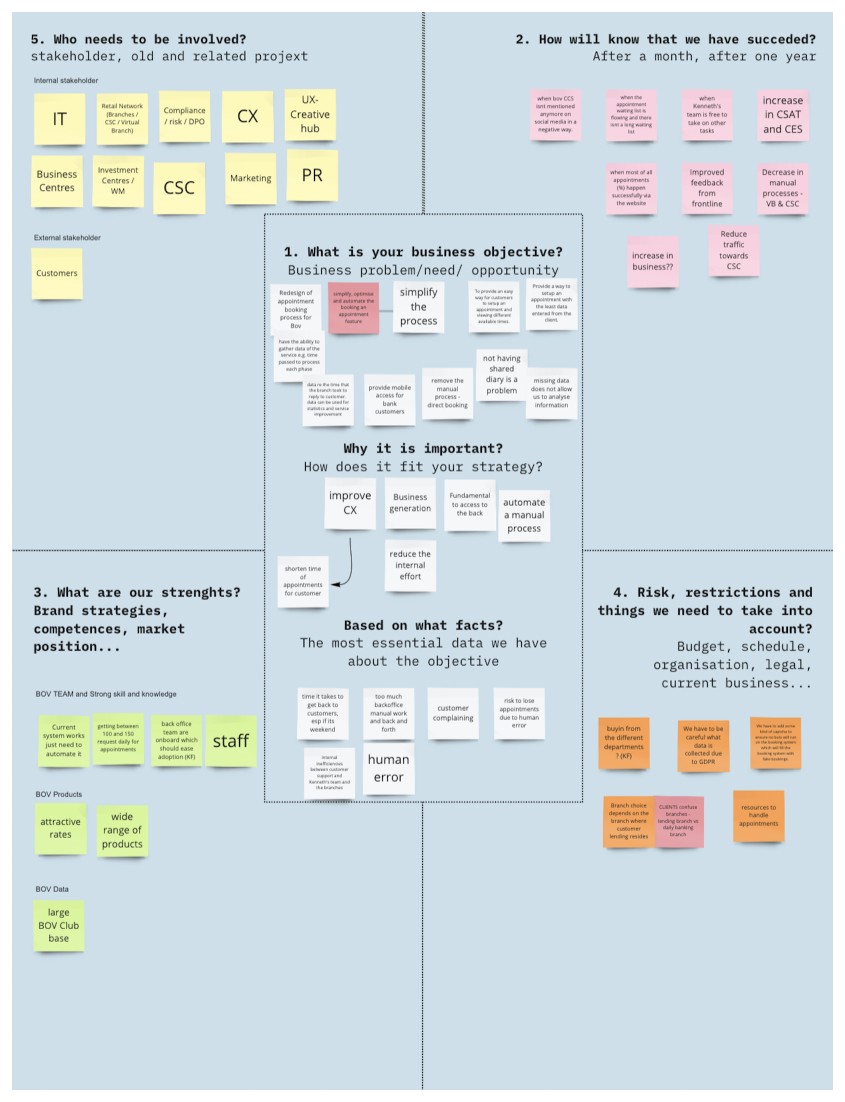

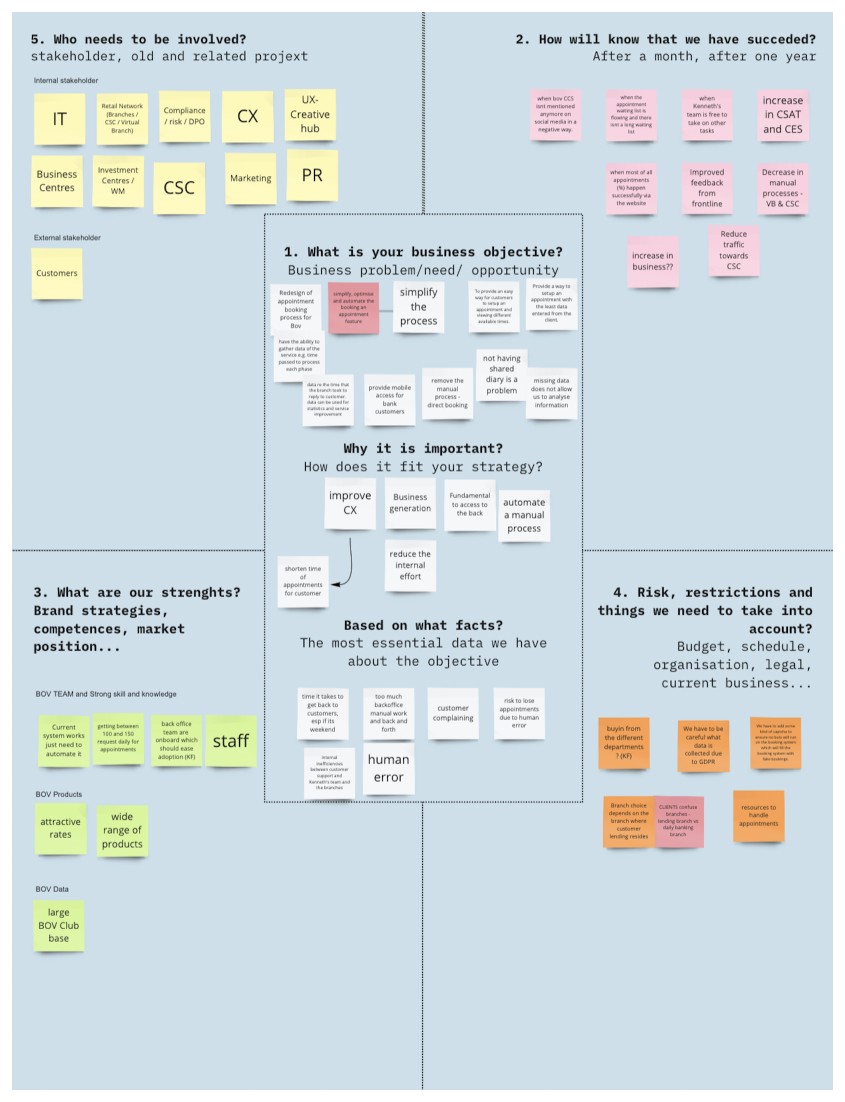

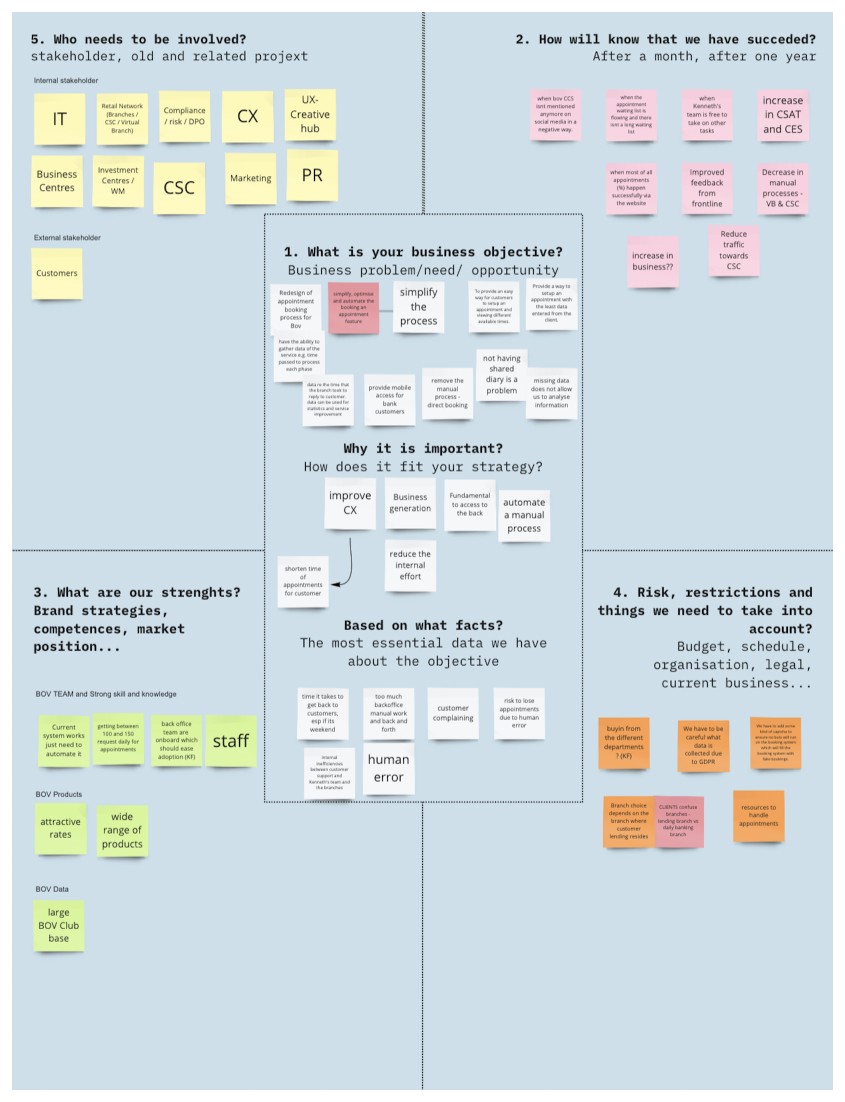

We started with a workshop involving stakeholders, during which we collaboratively filled out a canvas to outline the business objectives, identify additional stakeholders, determine the best outcome we could achieve, and identify any potential risks.

To gain a deeper understanding, we have taken the following steps:

Developed a flowchart of the current solution to pinpoint shortcomings and friction.

Conducted stakeholder interviews.

Conducted user interviews (Bank branch employee, Virtual branch employee, and two bank clients).

Developed 4 archetypes with their goals and pain points based on the most frequent users of the app.

Analyzed available quantitative data and customer feedback from support and social media channels.

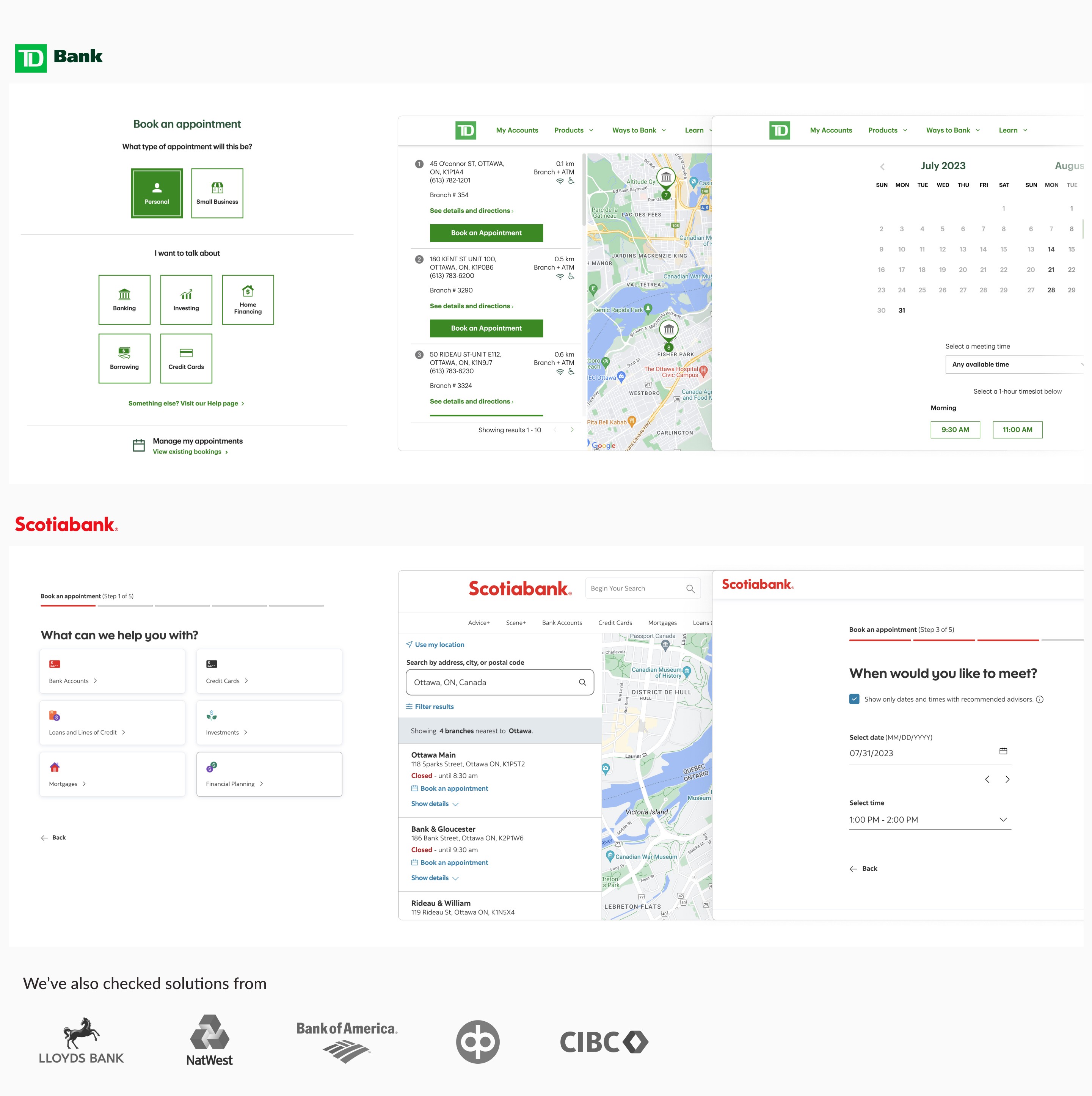

Conducted industry research to identify well-established patterns.

Learnings

Virtual branch employee interview:

It's hard to manage numerous appointments daily on top of the other services the Virtual branch provides while maintaining high customer satisfaction levels with efficient speed.

Customers frequently schedule an appointment at a branch where their documents are unavailable.

Bank branch employee interview:

Many clients inquire about the branch's operating hours after 5:00 PM to see if they can visit it after work.

Having trouble booking appointments in the shared diary because some of my colleagues forget to close it, which leaves it locked.

Has low confidence in technology.

Bank customers interviews:

The current system does not effectively communicate what to expect in the following steps.

The current system fails to build trust in new customers.

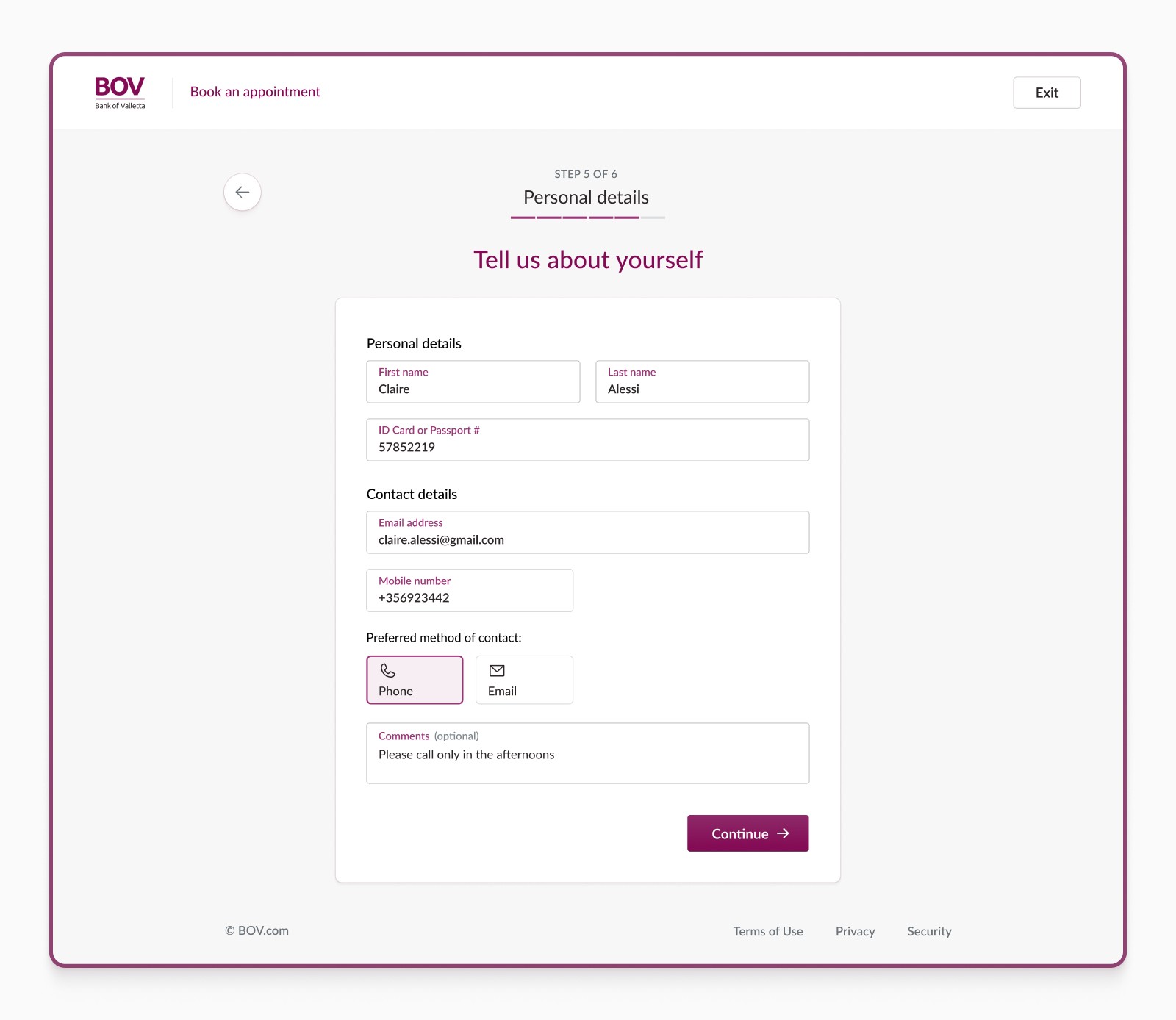

The current system requests unnecessary information, causing customer frustration and slowing the completion process.

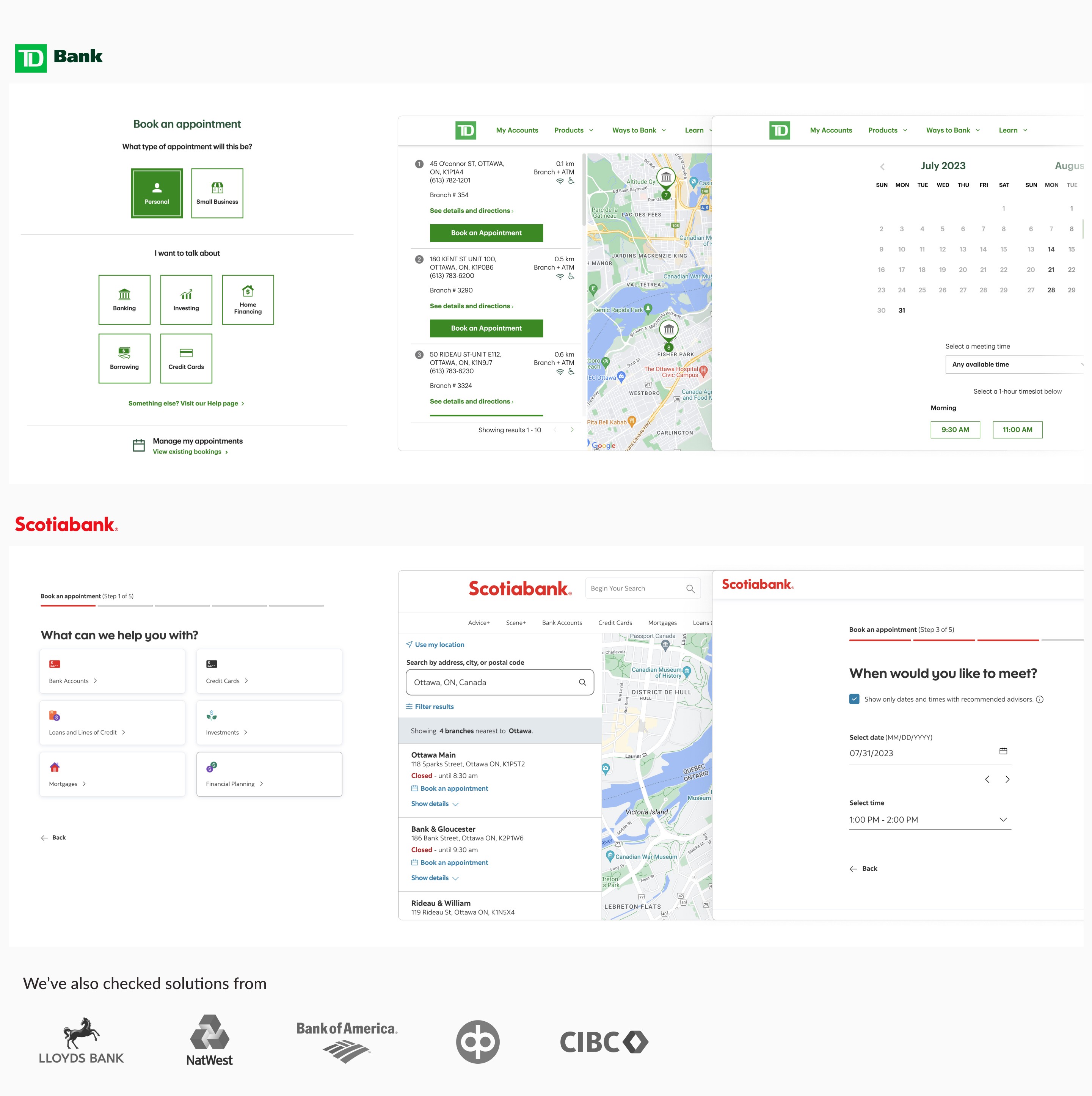

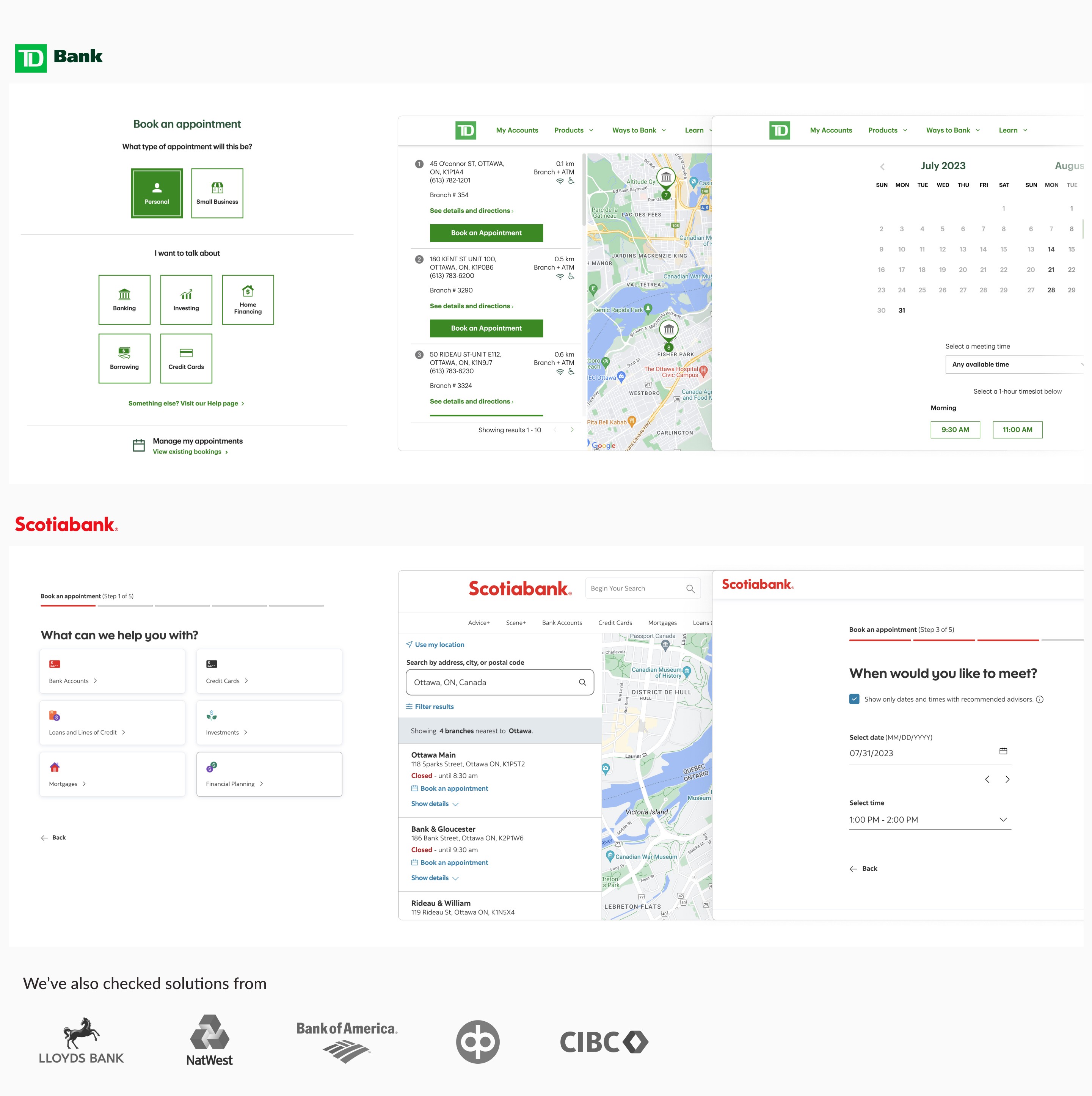

During our industry analysis, we discovered the proven best practices

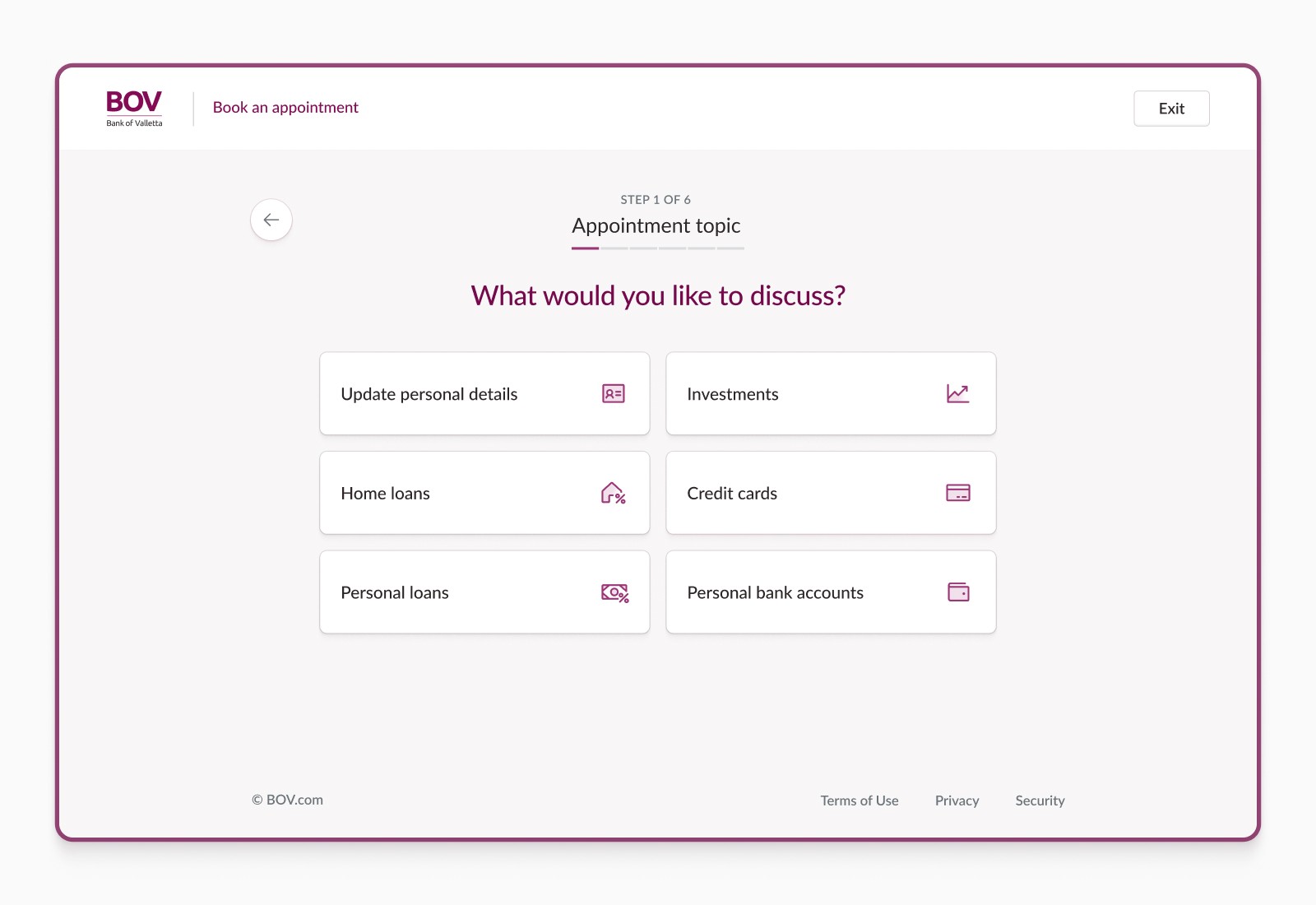

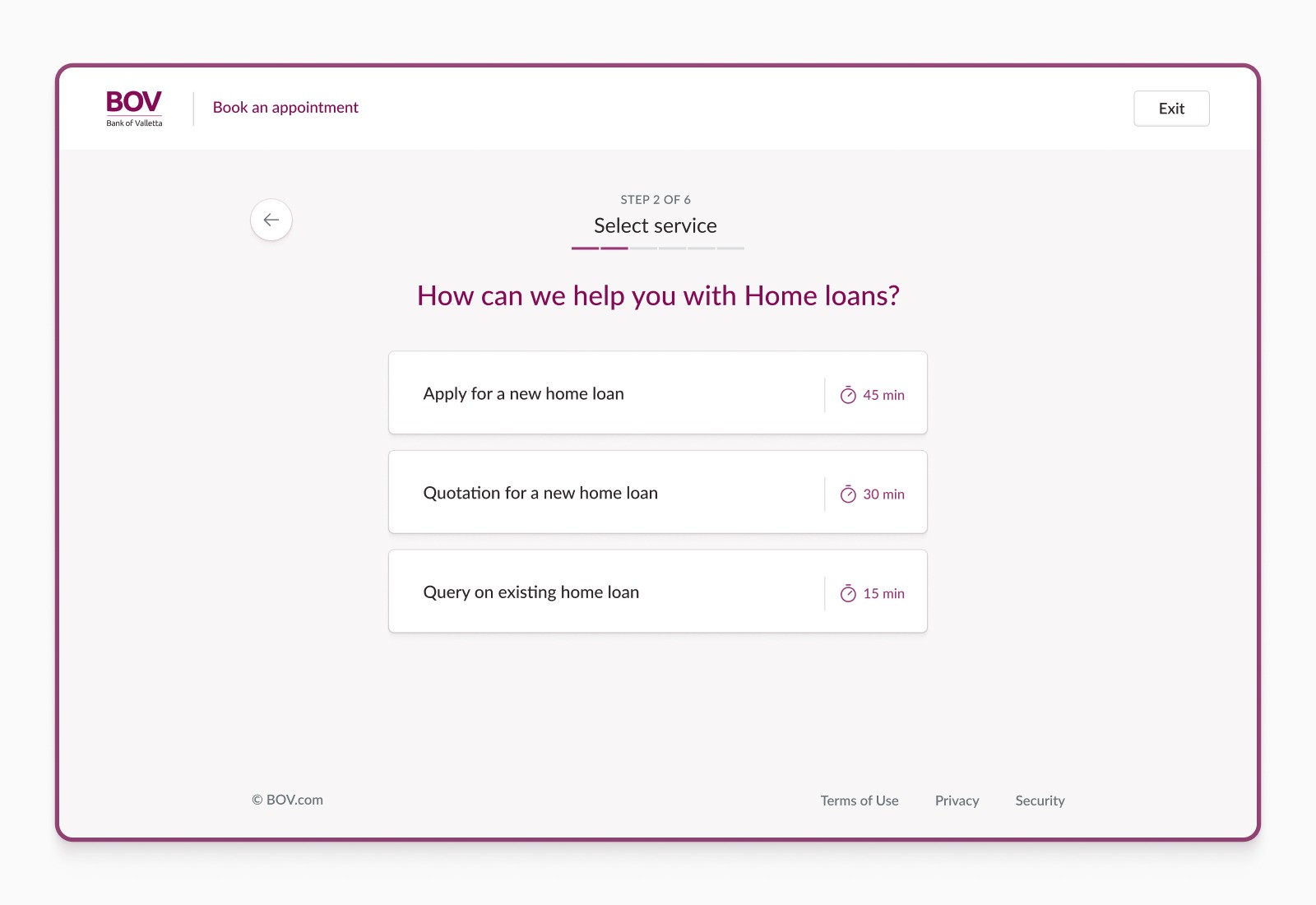

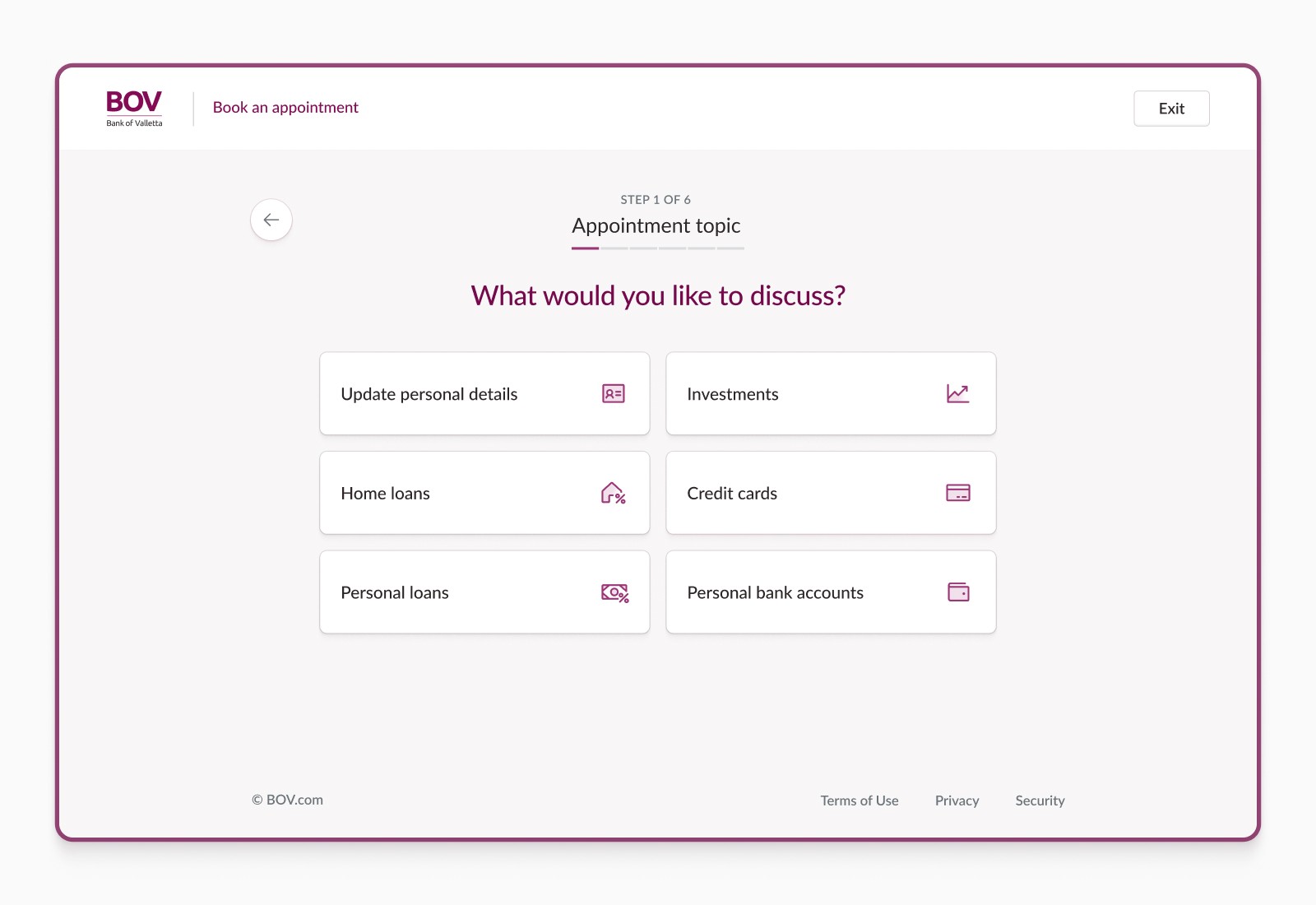

Materialize

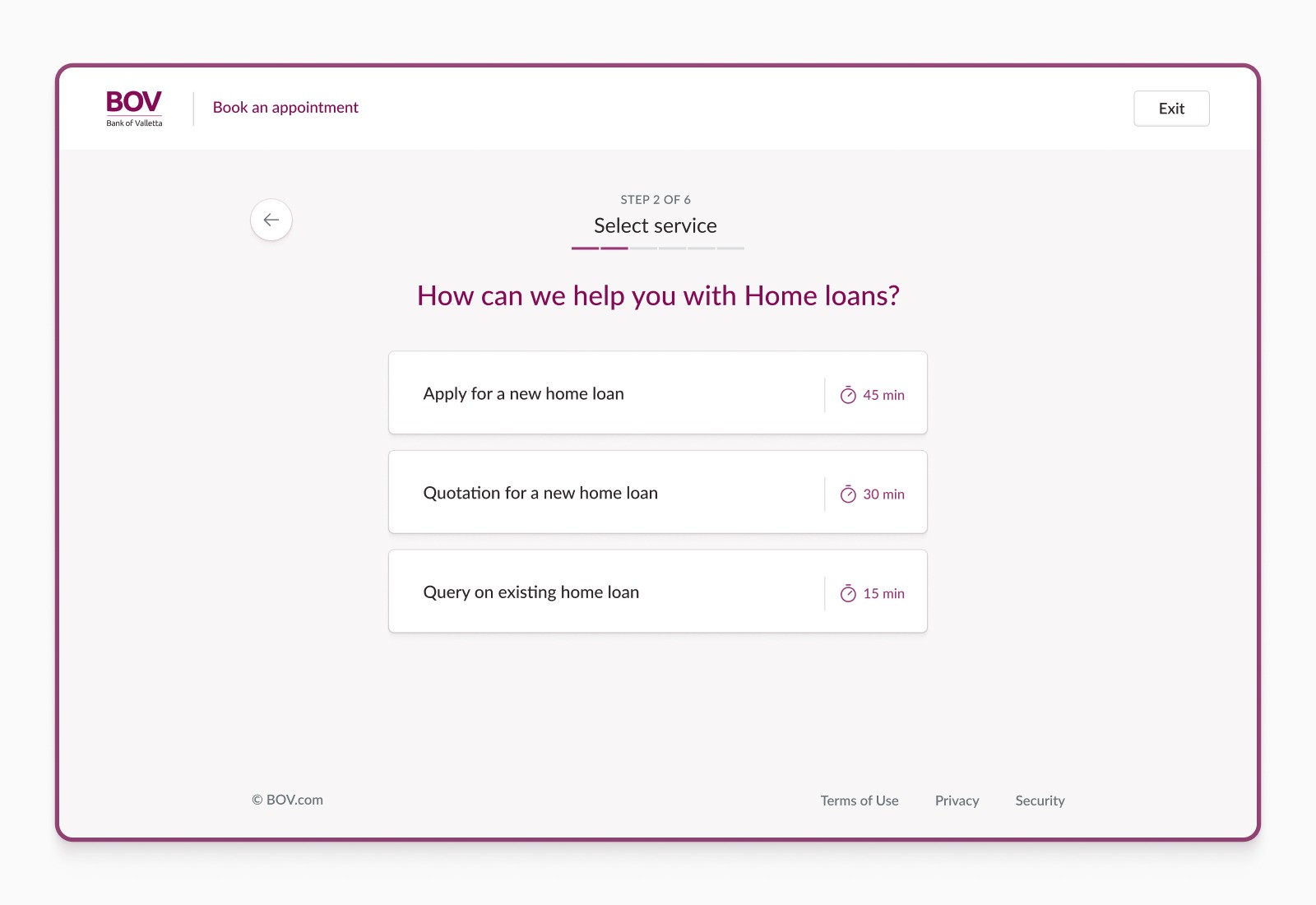

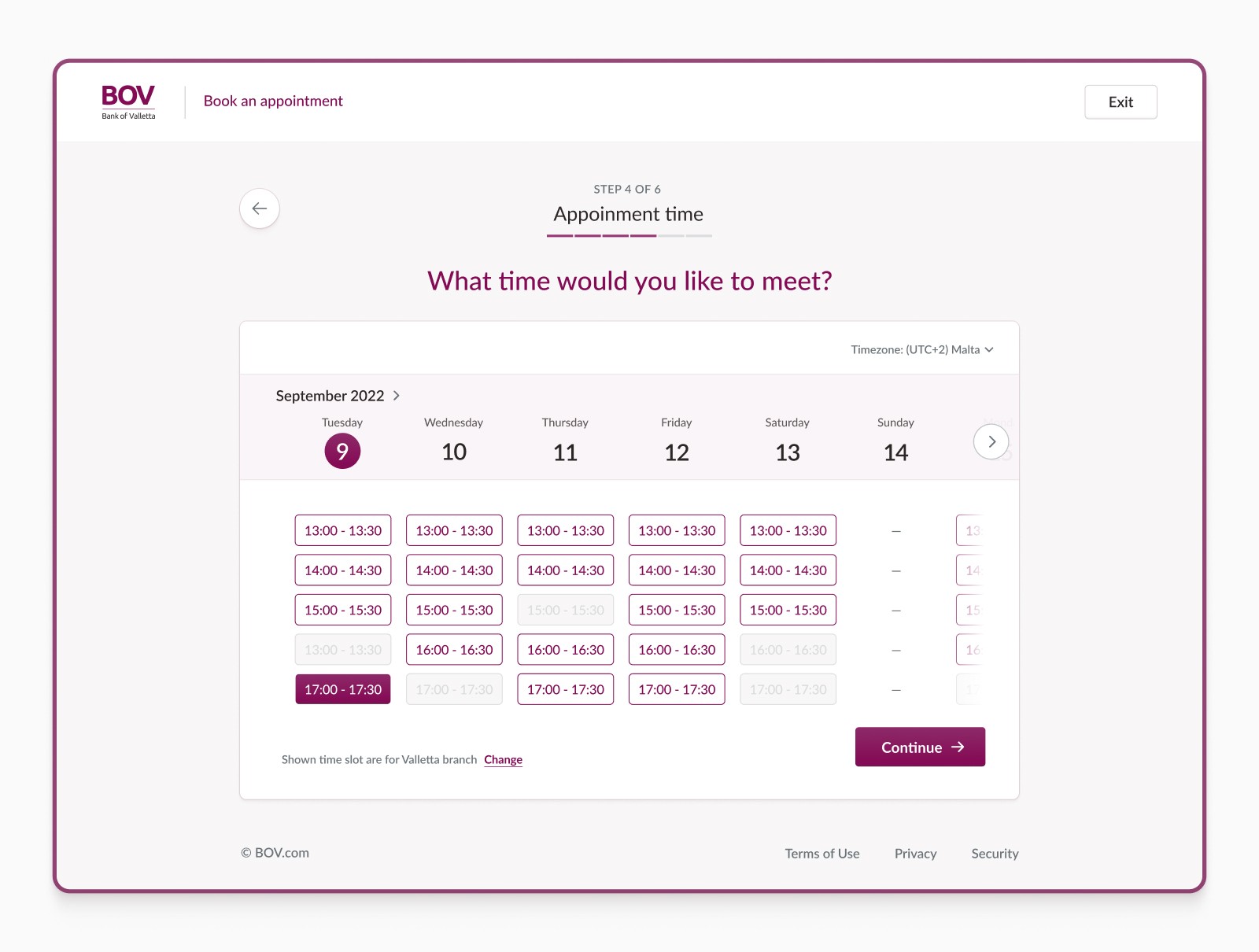

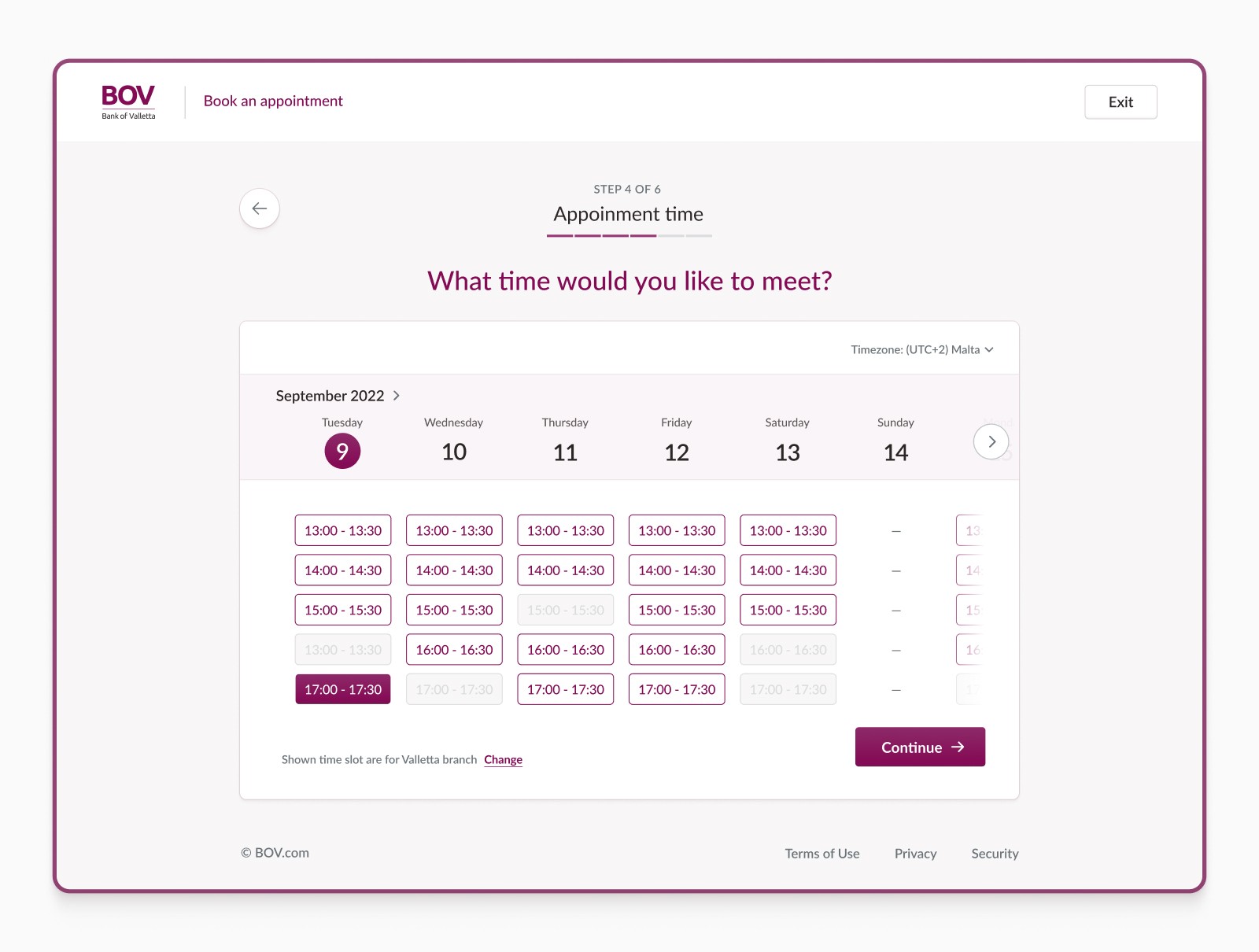

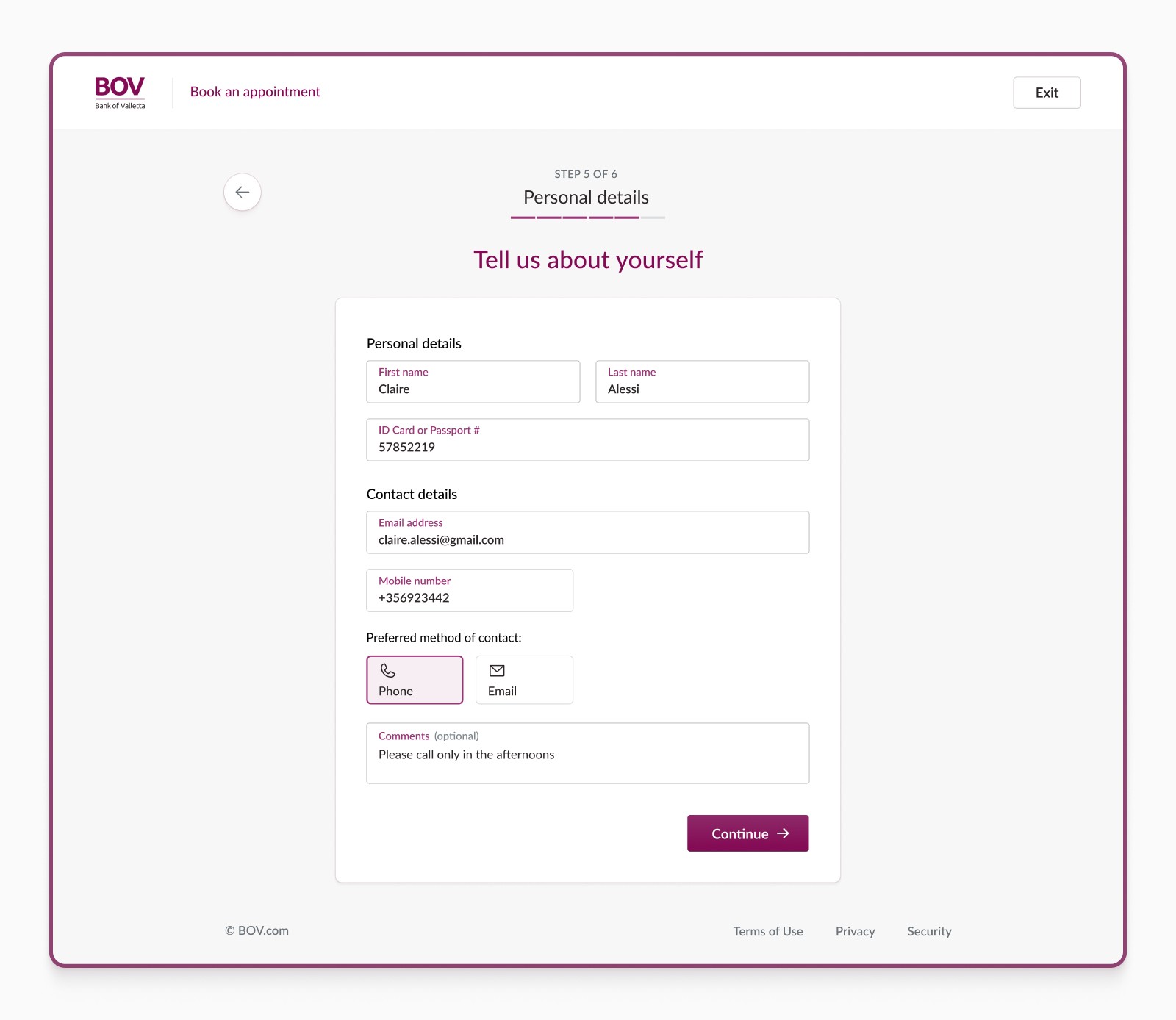

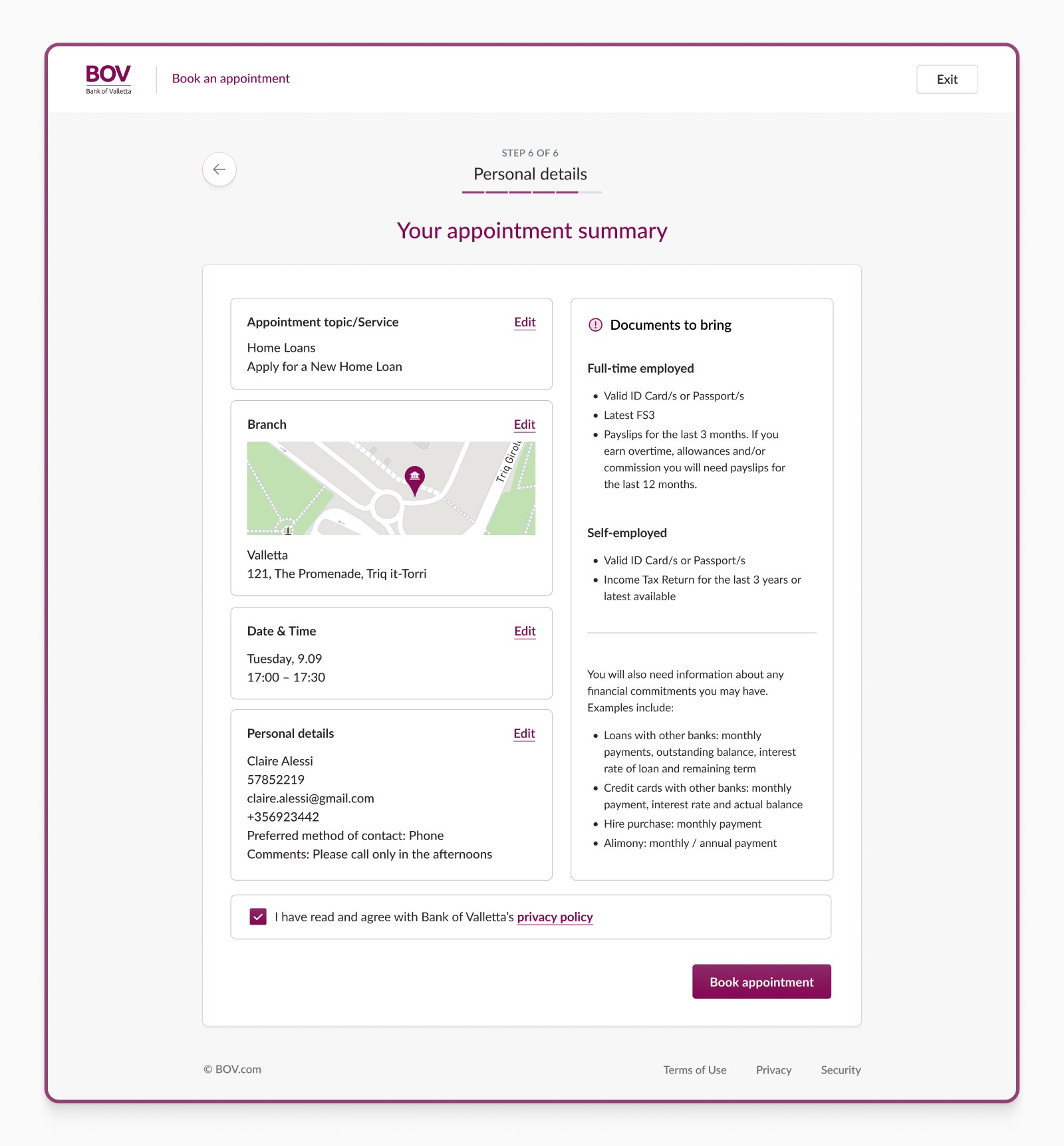

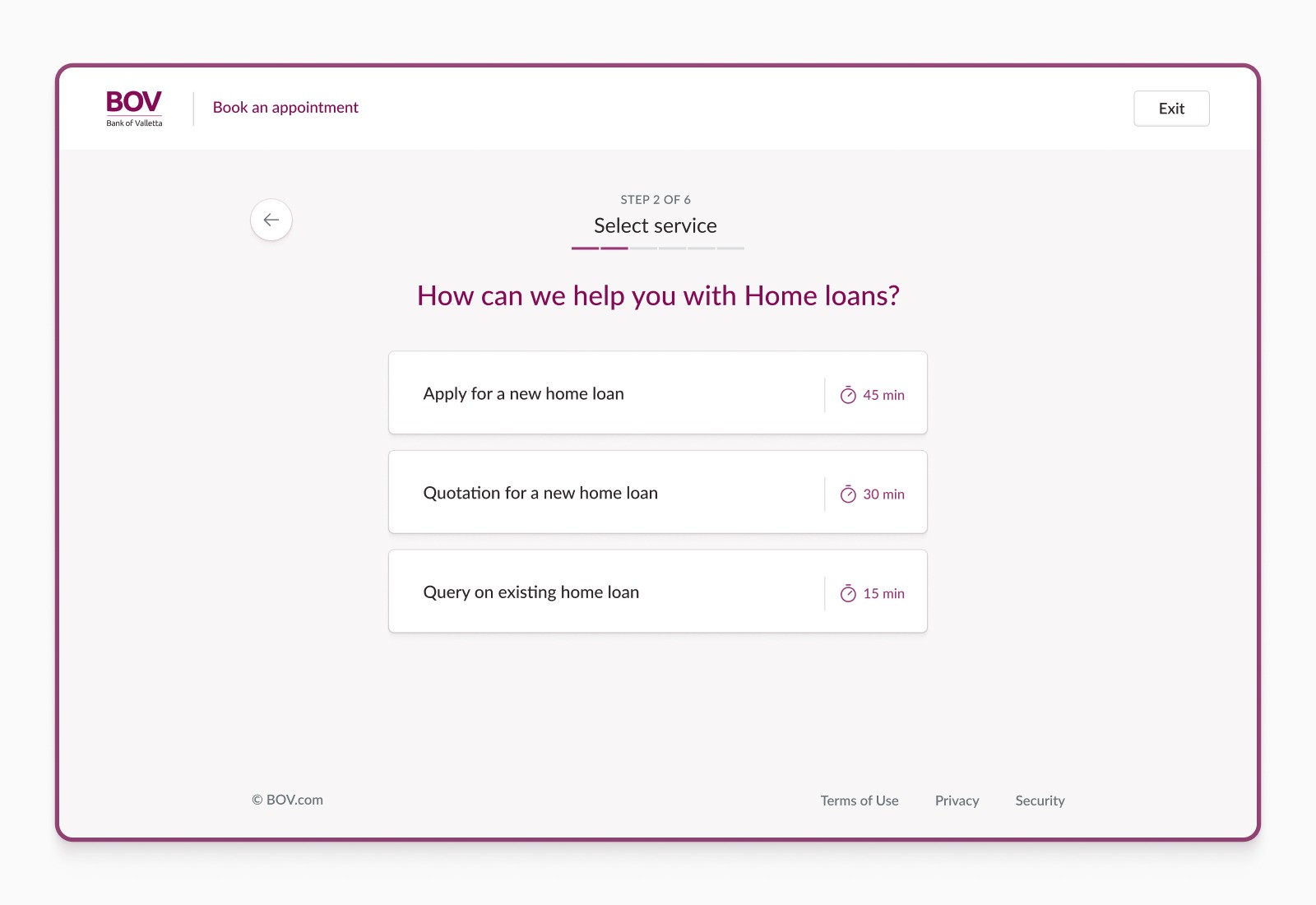

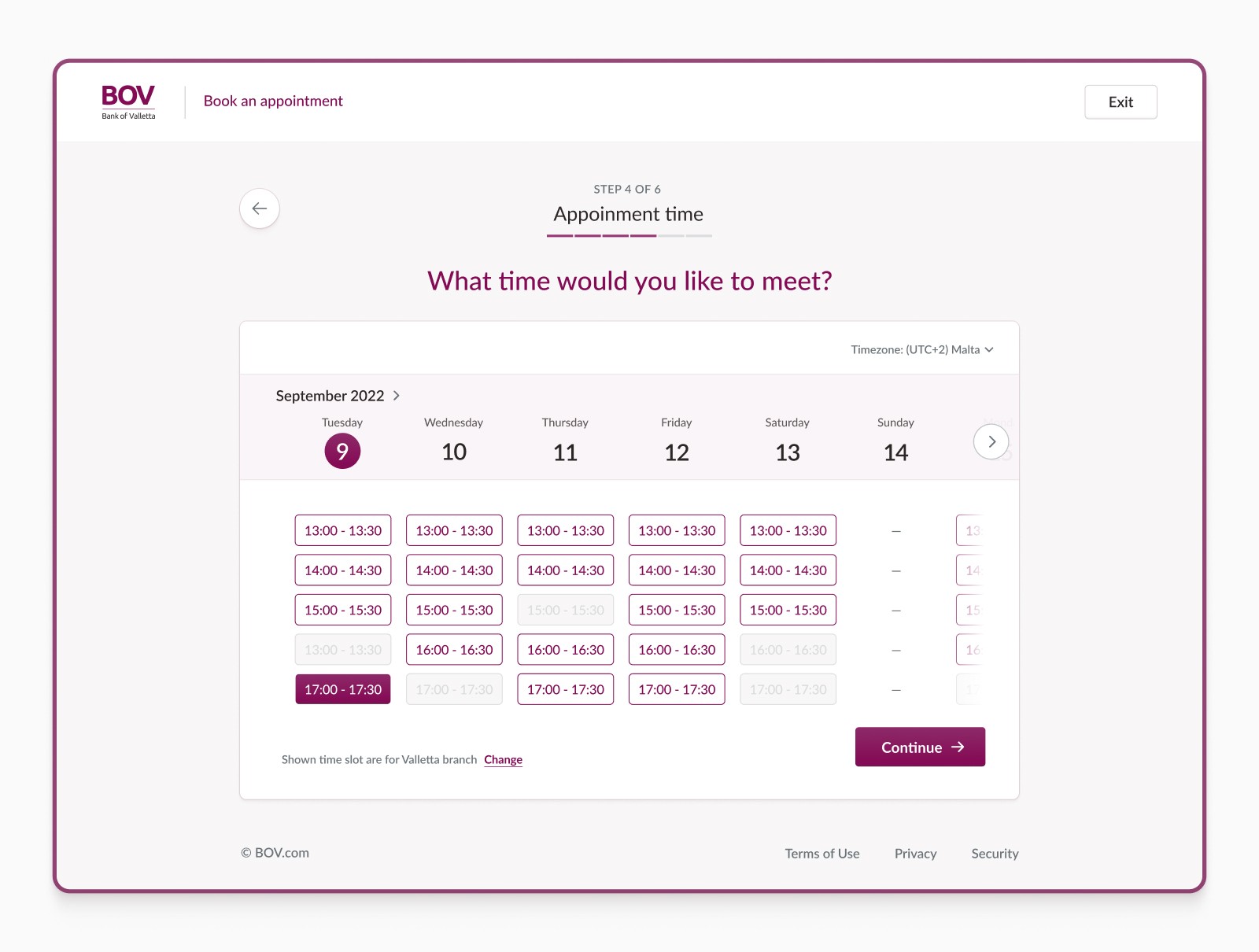

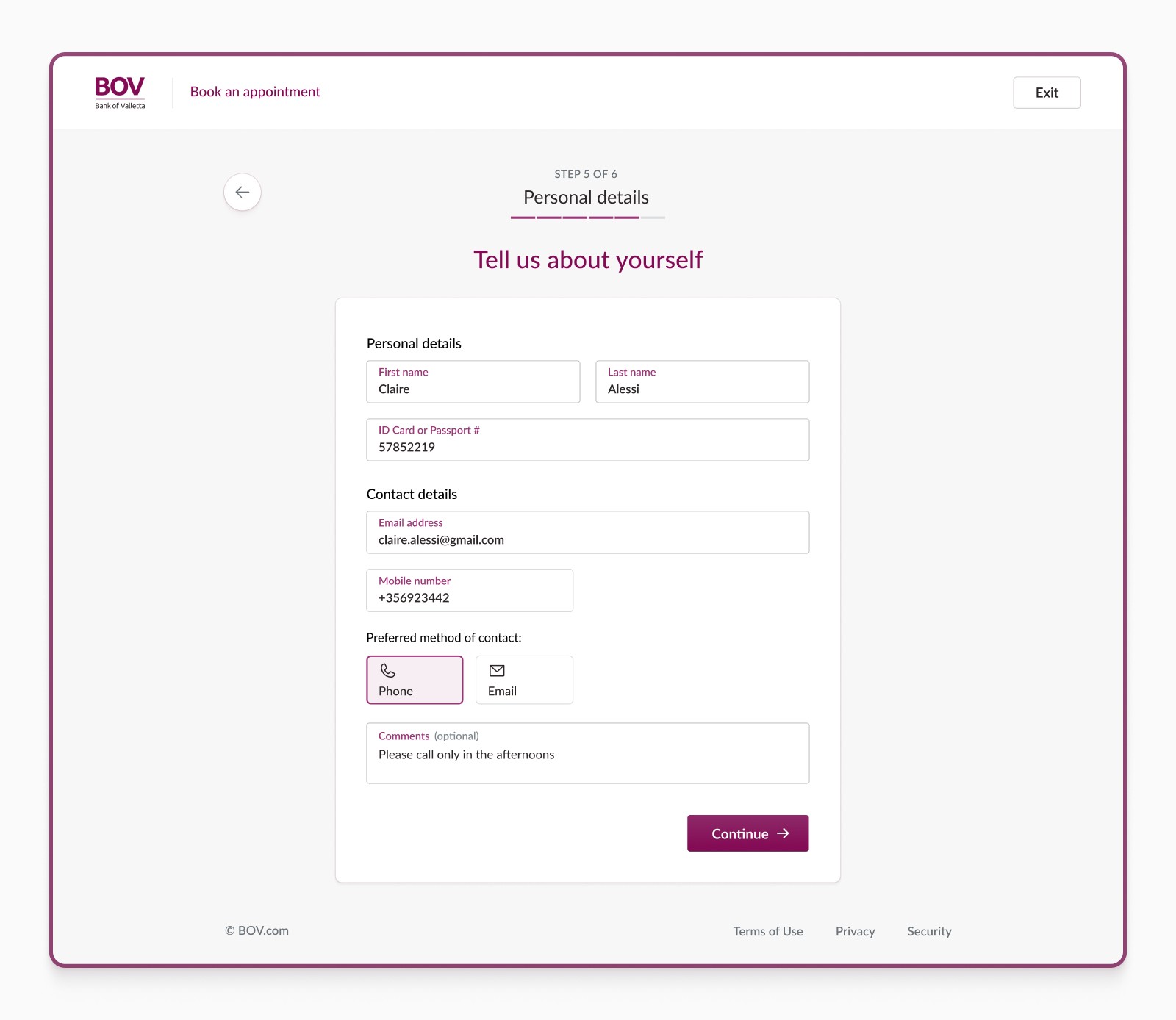

With the knowledge acquired, we formed a hypothesis on how to solve these challenges and started iterating toward the final solution.

Drawing from the insights gained during the Discovery phase, the engineering part of the team provided recommendations for addressing the issues with appropriate technological solutions. I will focus on the design part in the following lines.

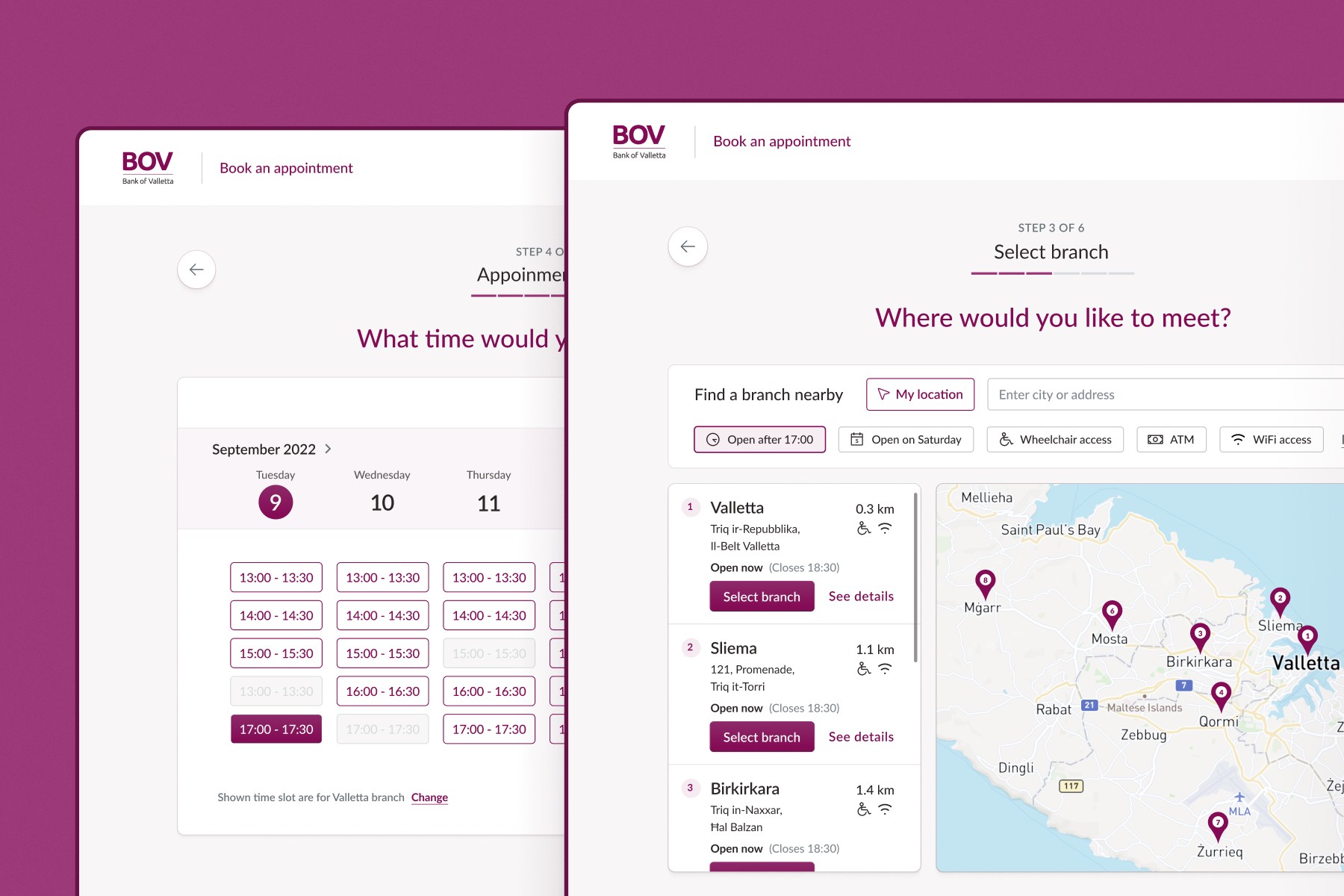

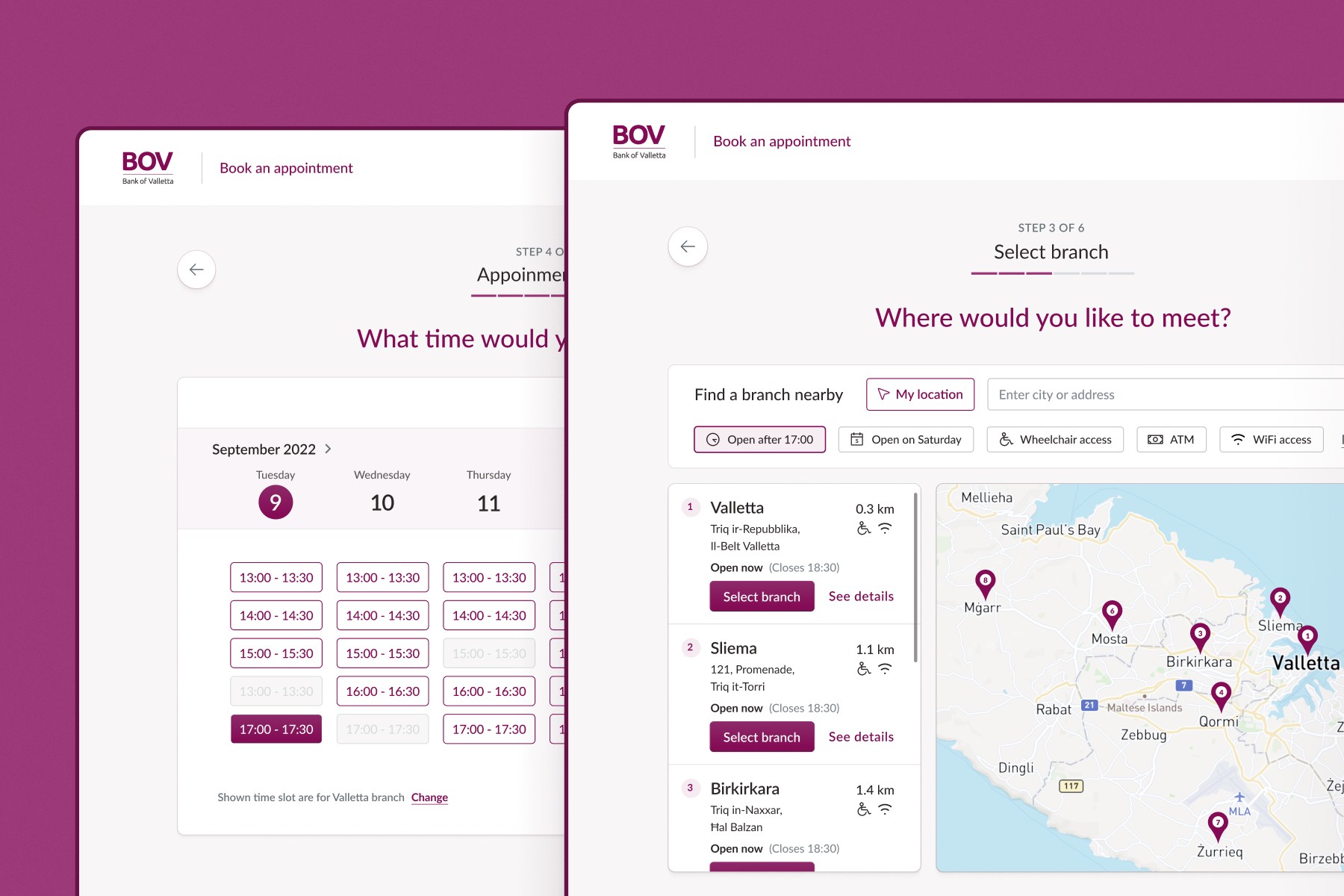

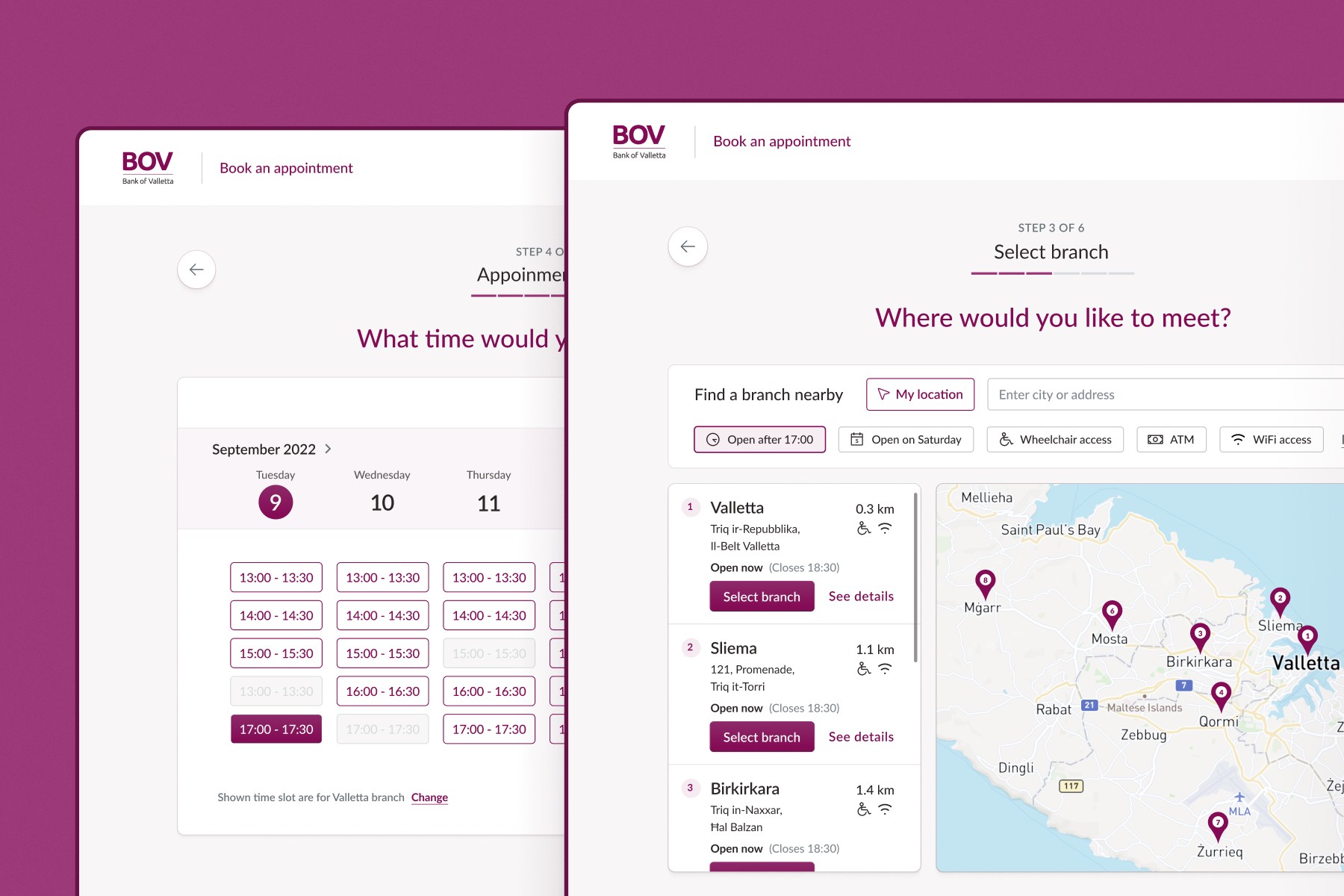

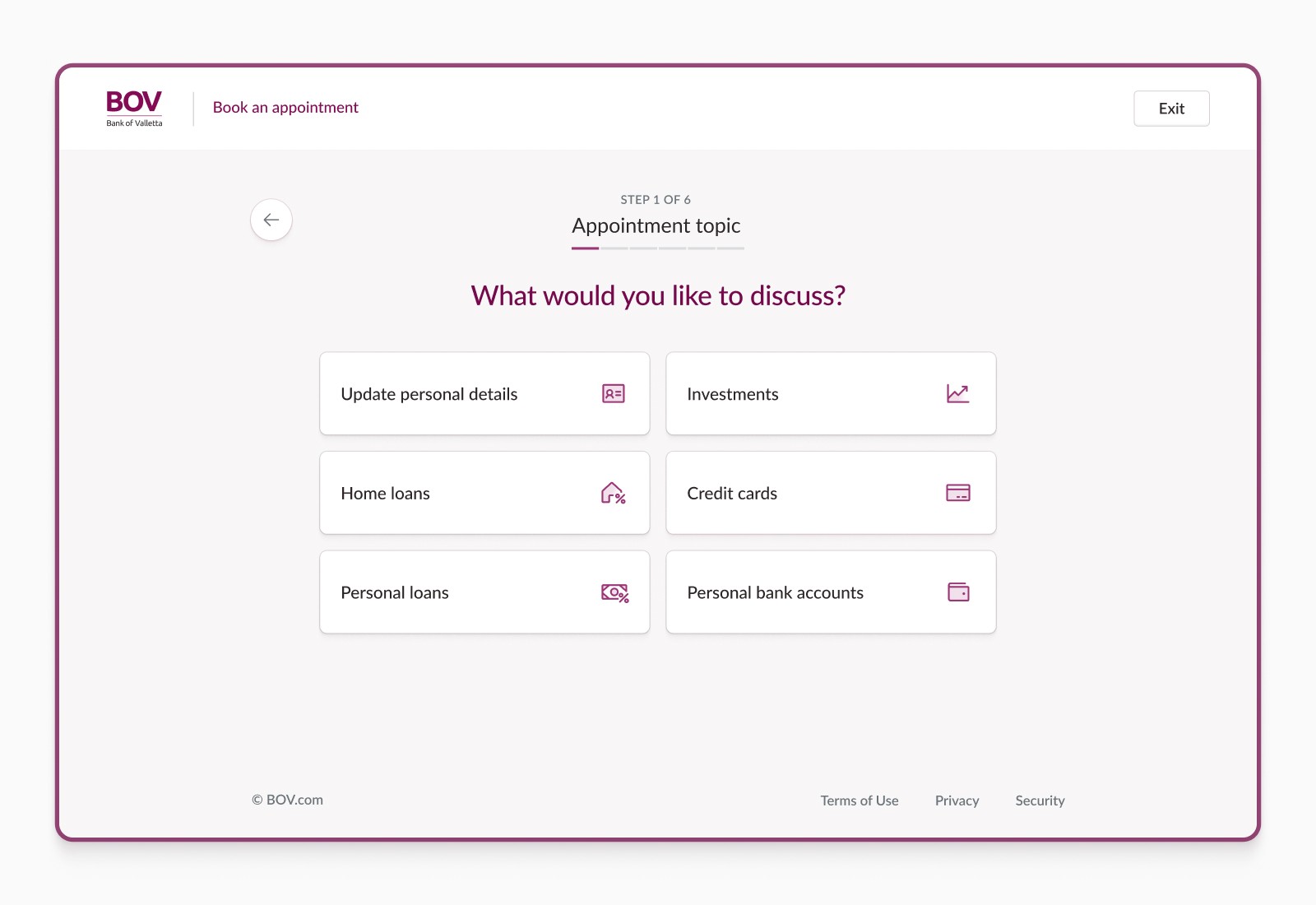

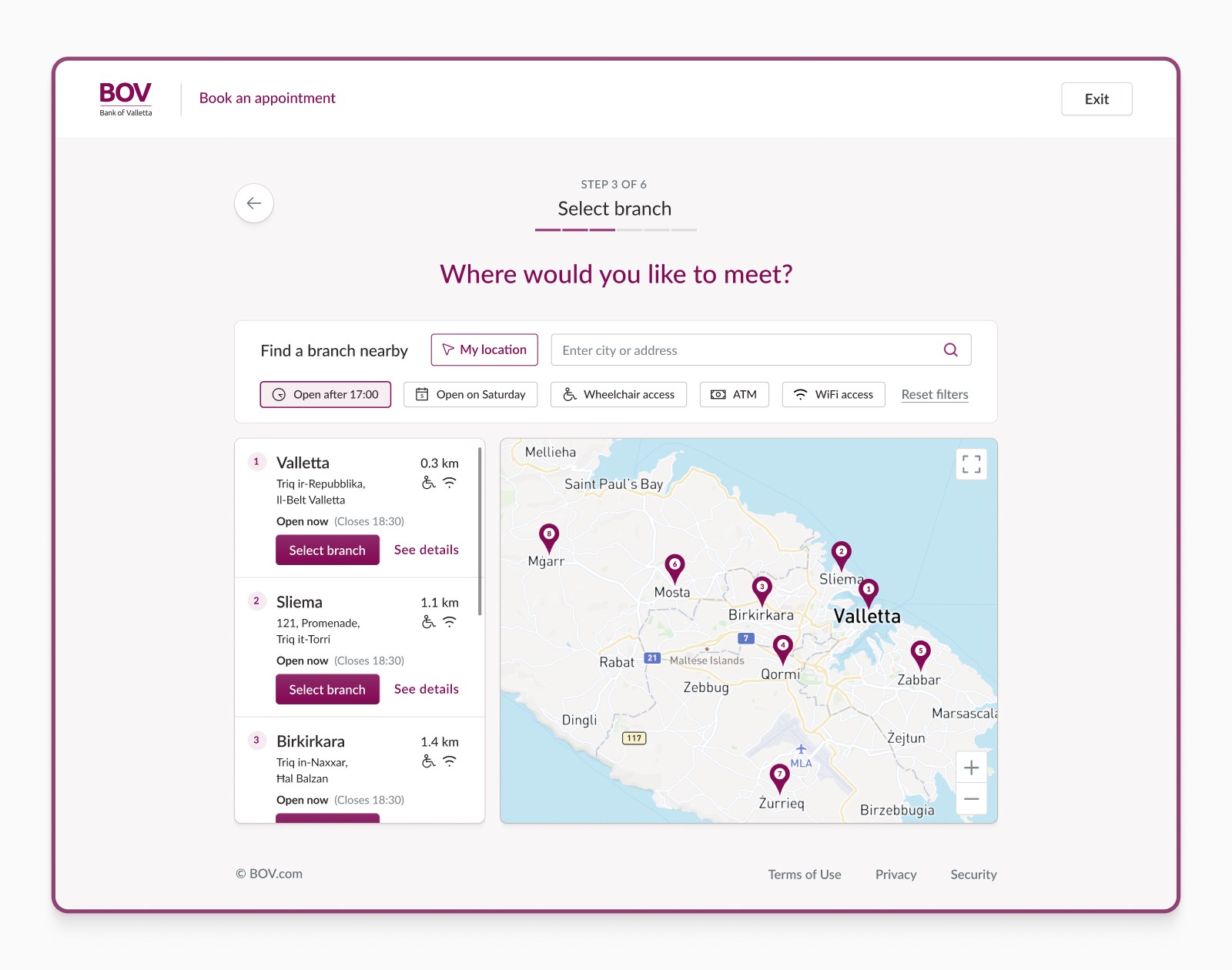

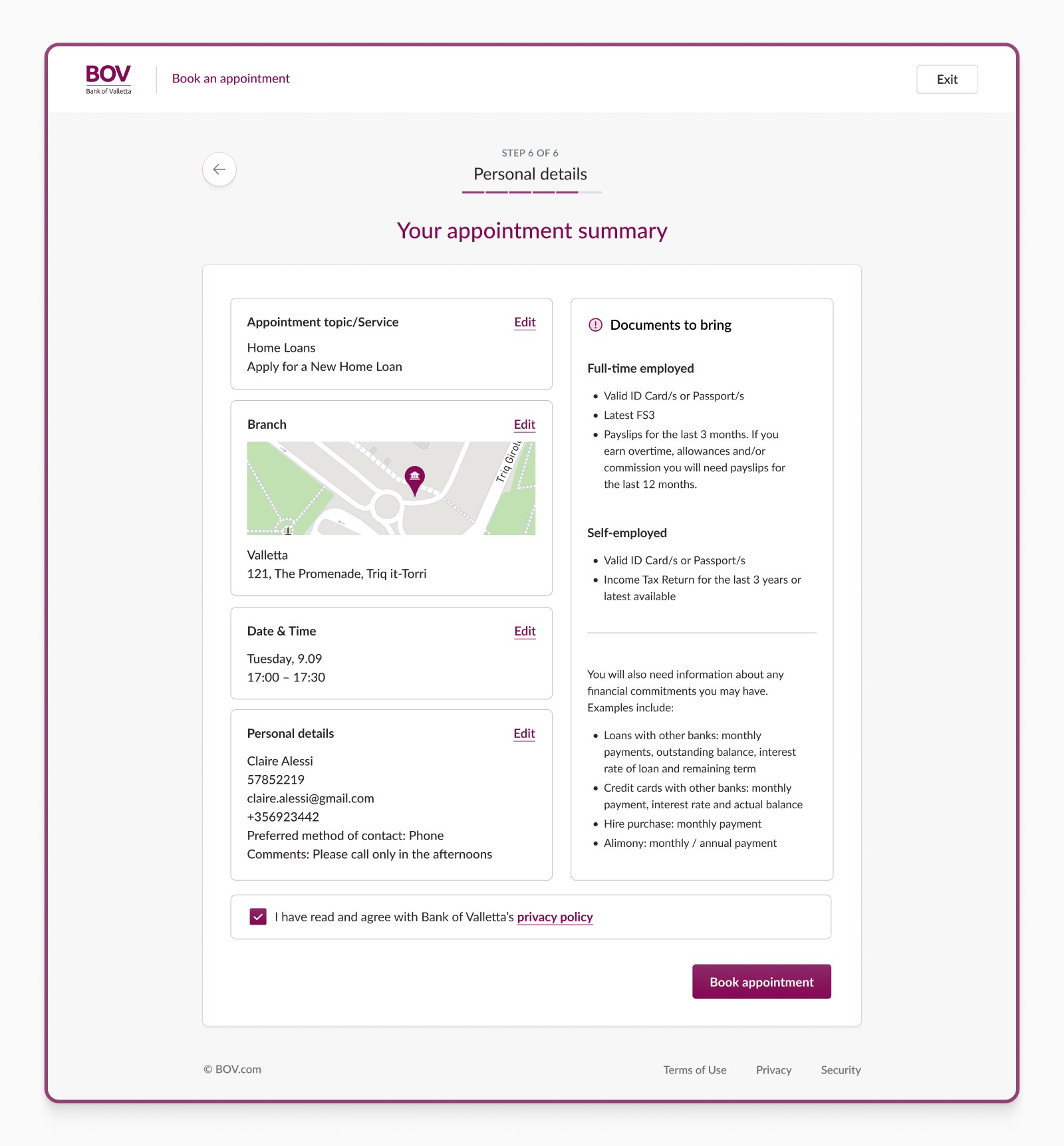

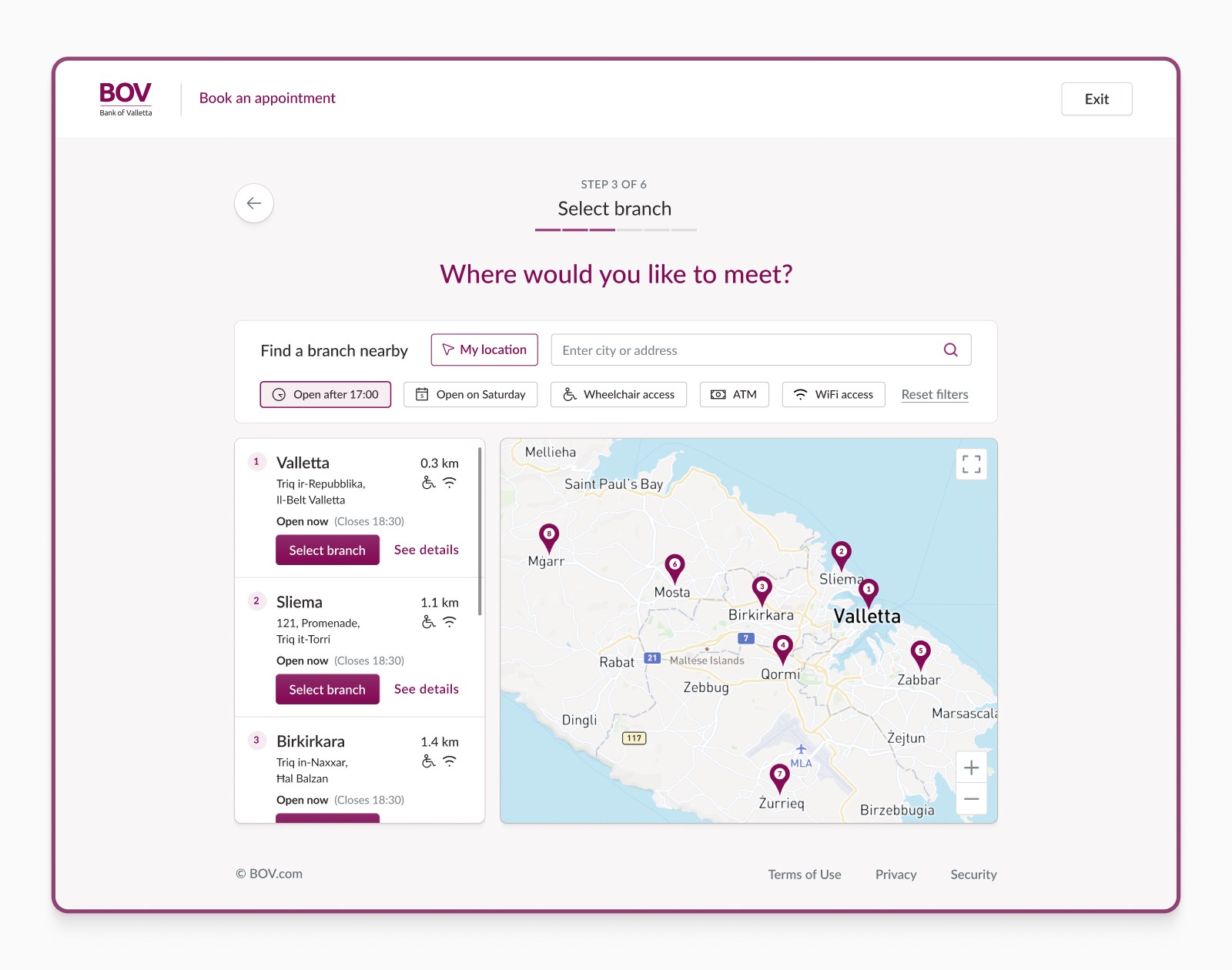

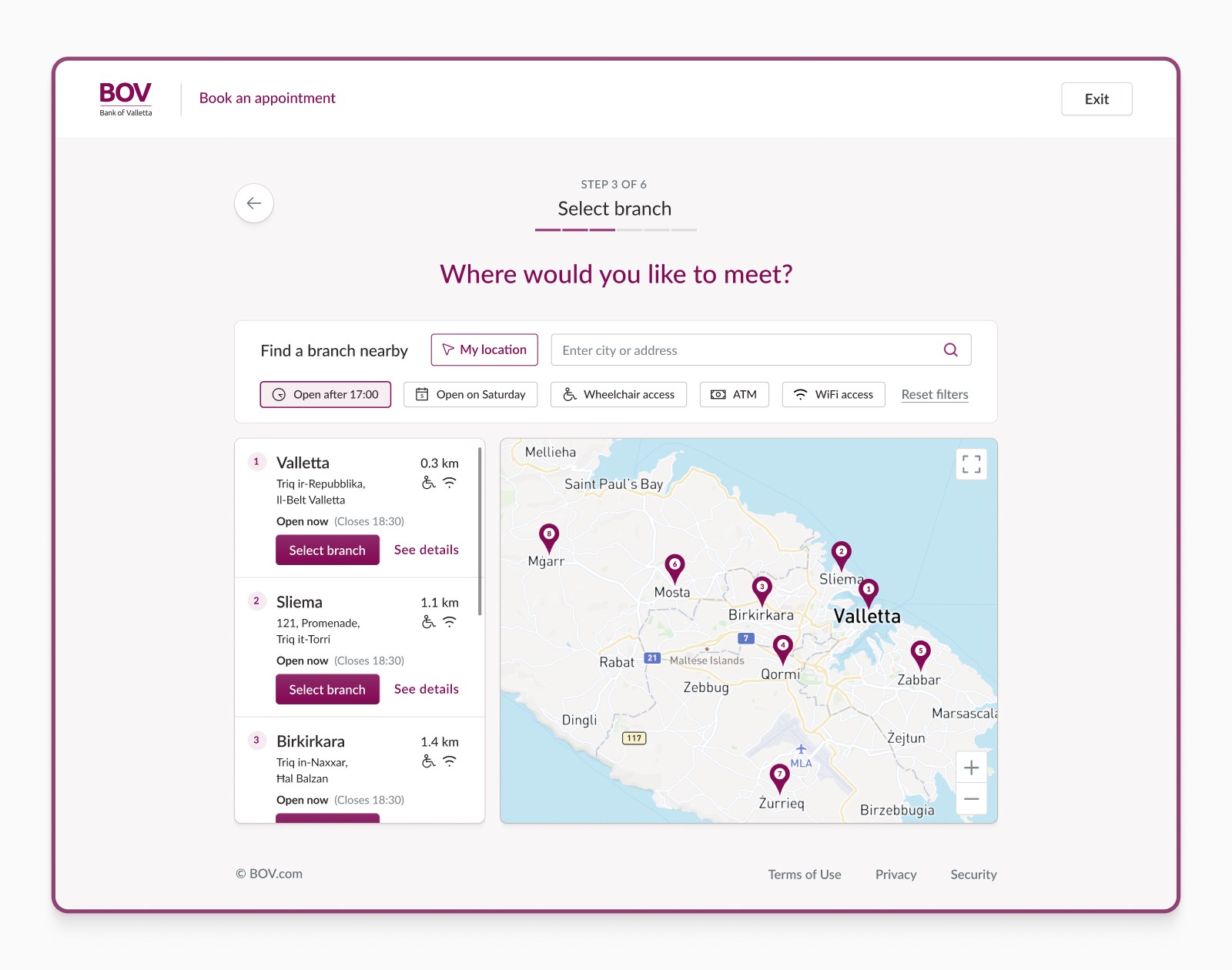

Depending on the service selected in the previous step, we list only the branches that offer this service. This way, we eliminate the option to book an appointment in a Branch which doesn't provide the service. Additionally, the user can quickly filter the branch list to show, for example, only ones that work past 17:00.

Once a booking is made, the system sends a confirmation email followed by a friendly reminder email the day prior to the scheduled appointment.

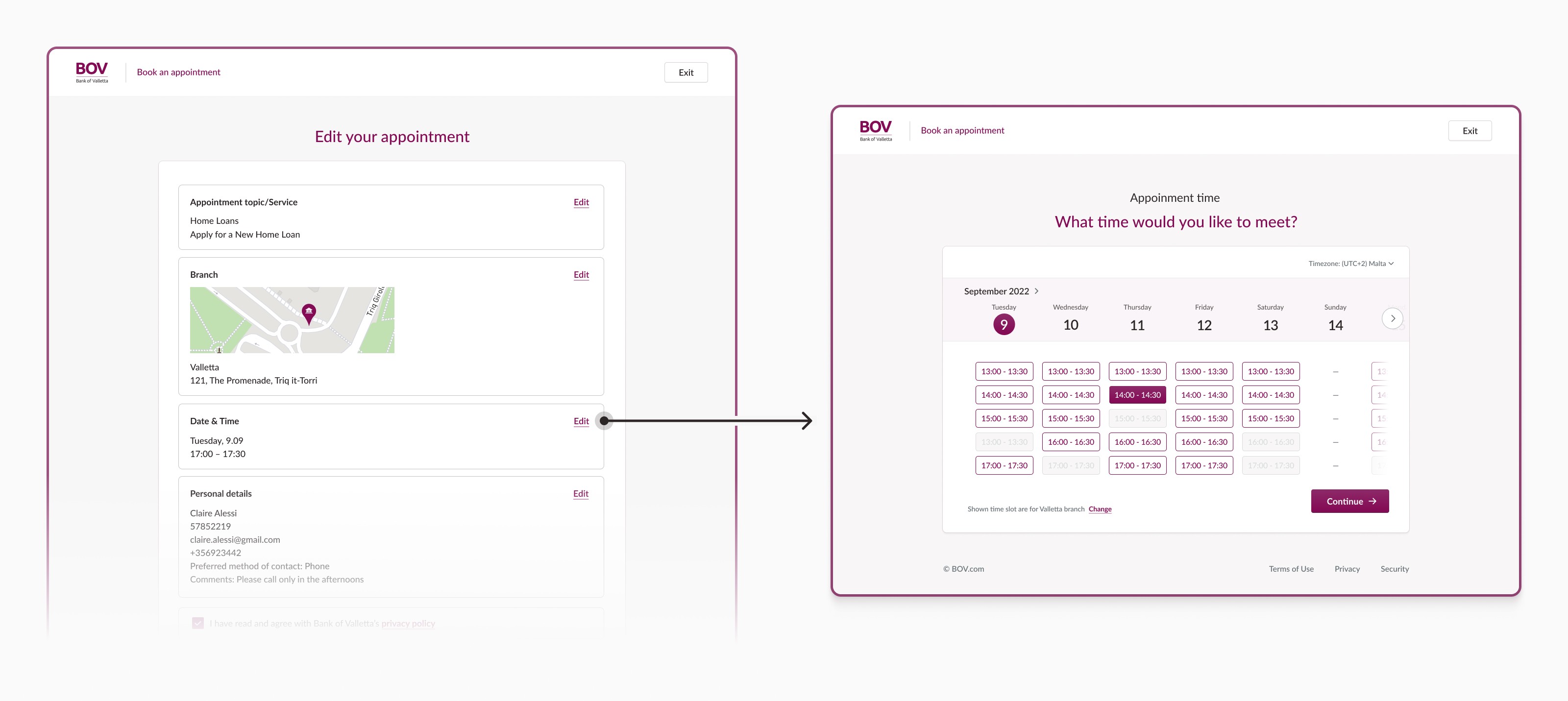

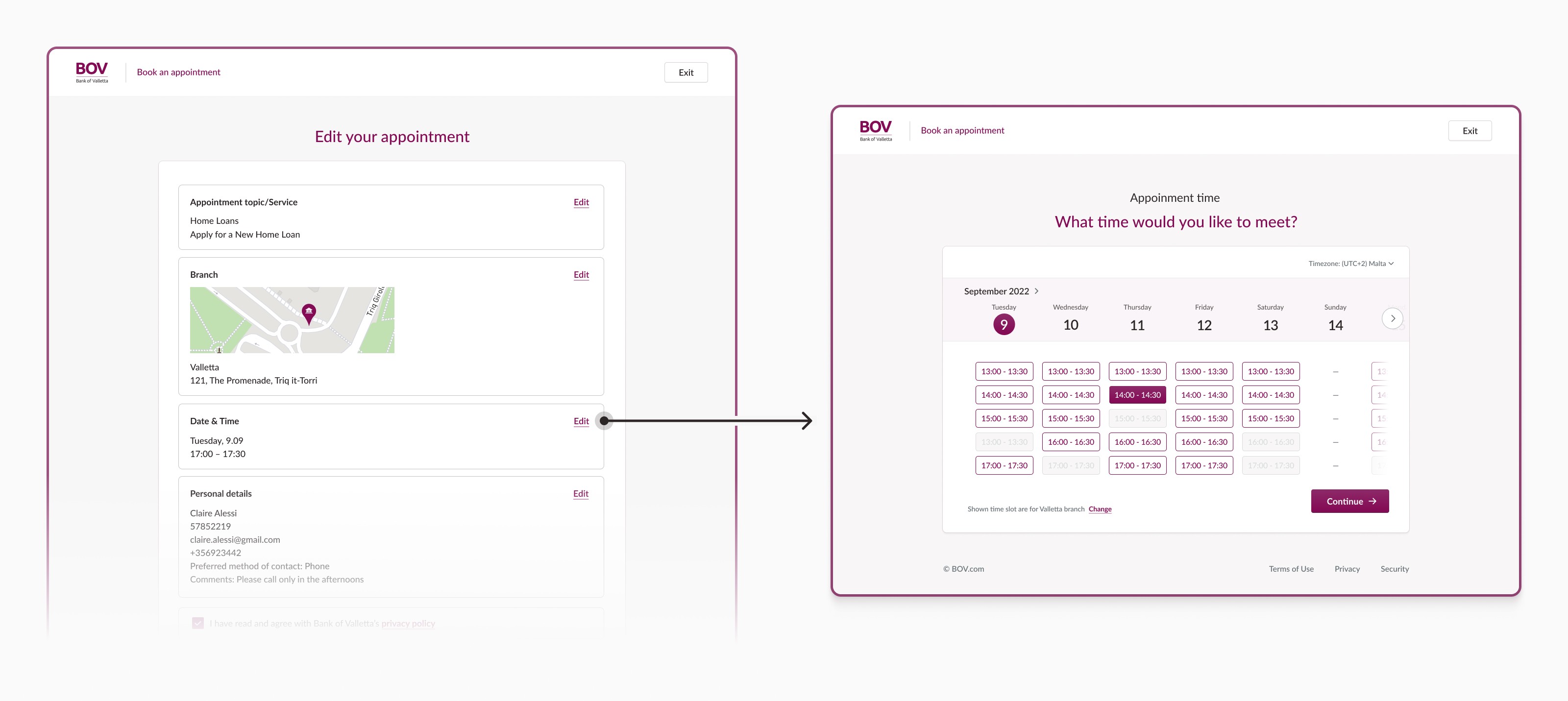

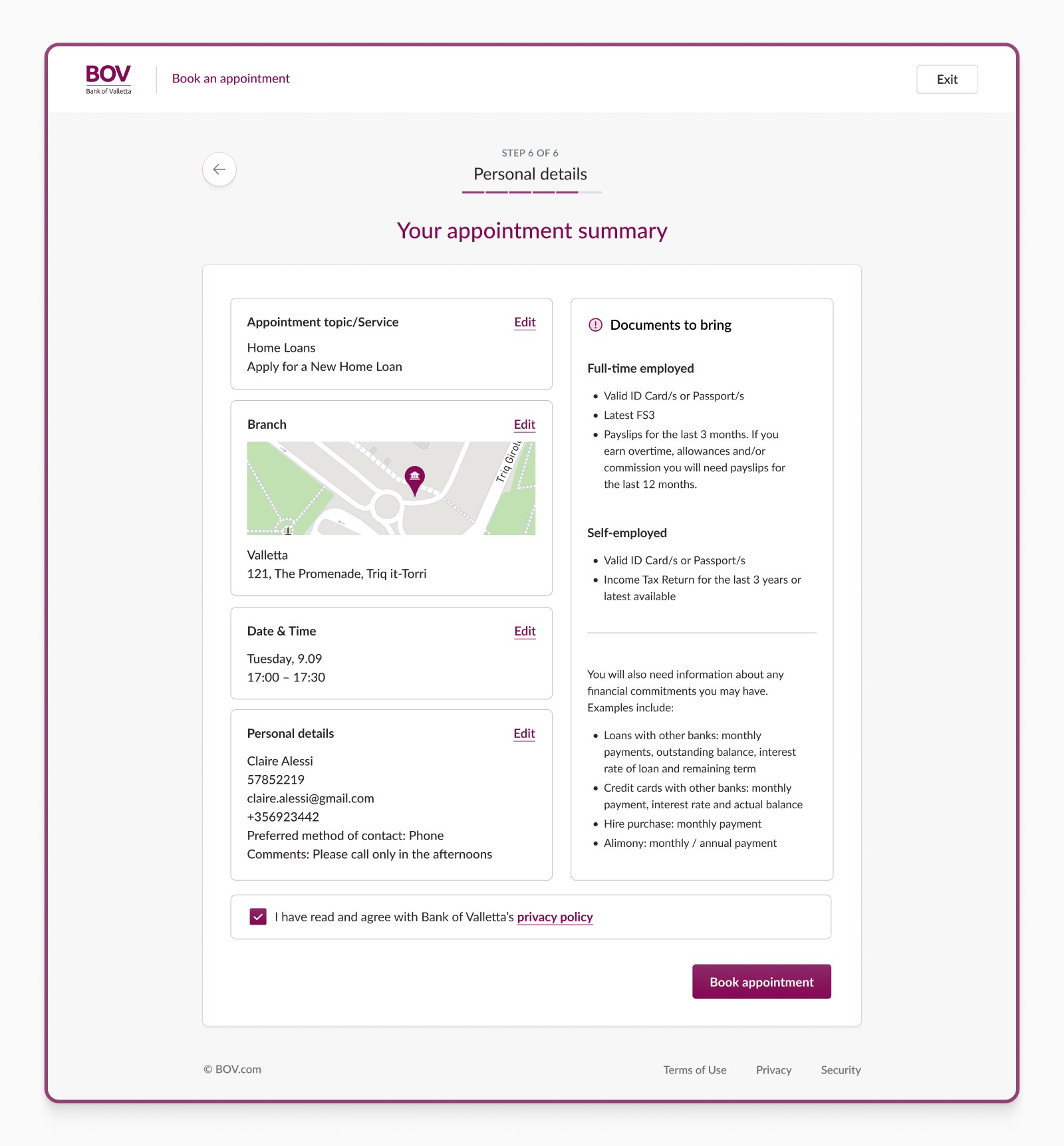

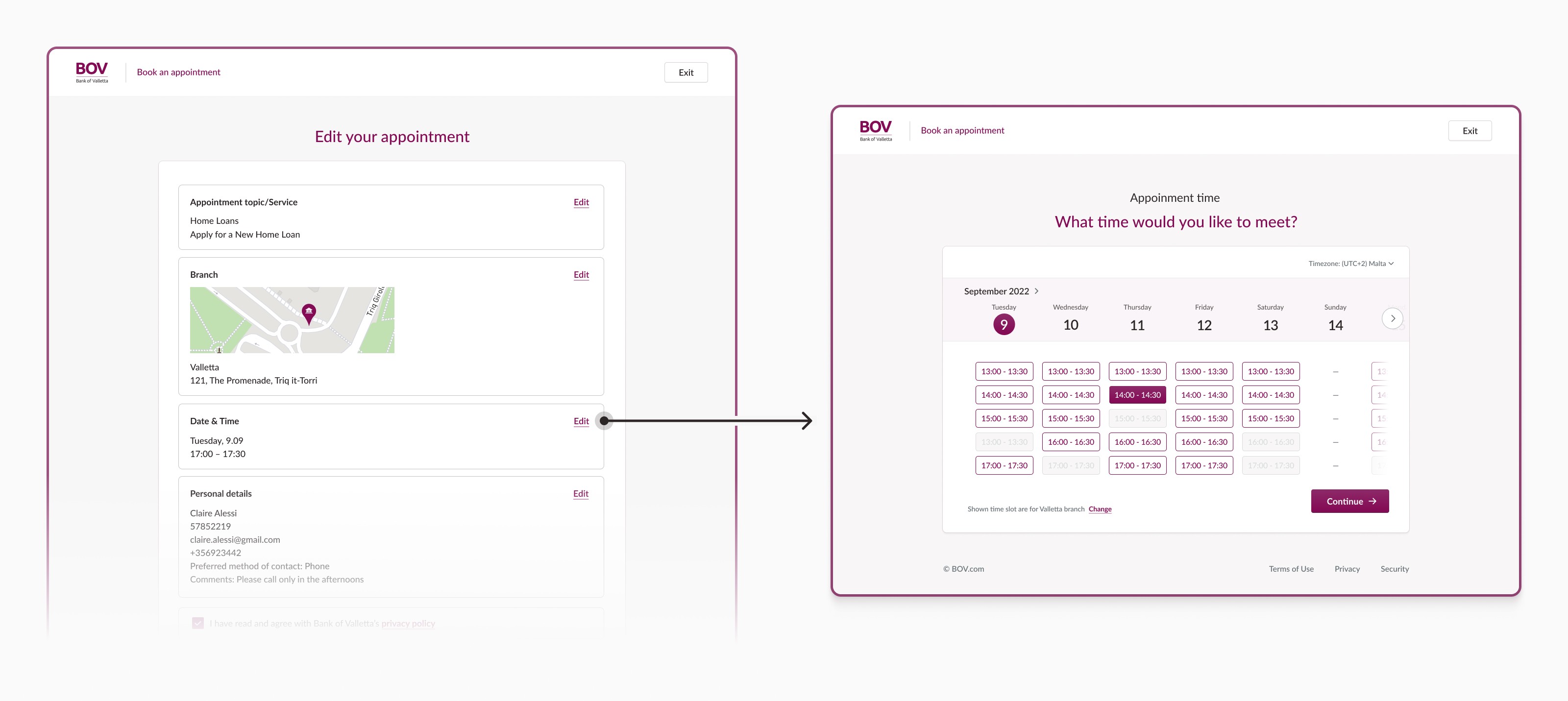

No more need to call the branch to reschedule your appointment

With the self-editing feature, customers have complete control over their bookings, eliminating the need for any interference from the bank and drastically reducing the risk of errors in the back office.

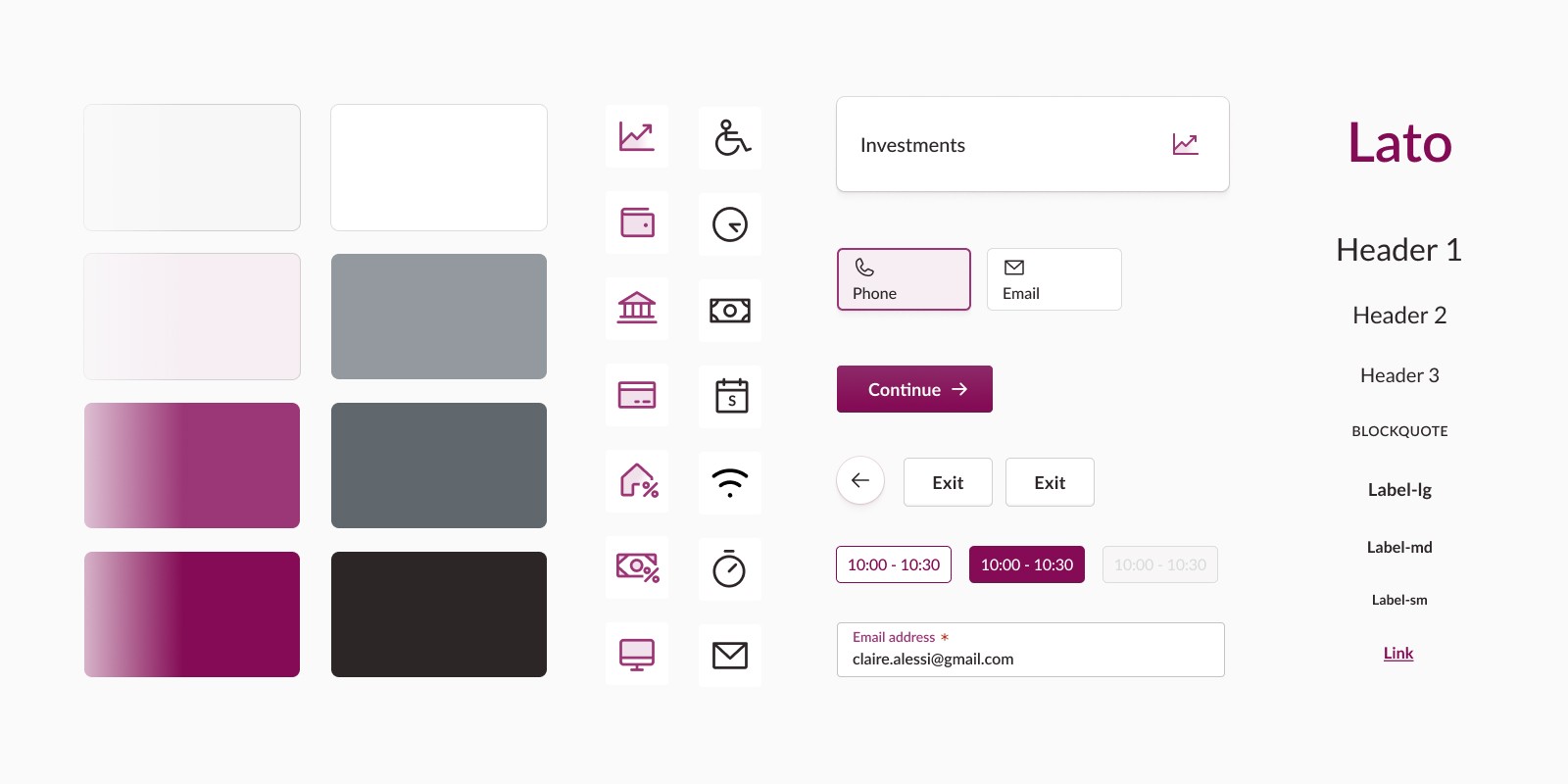

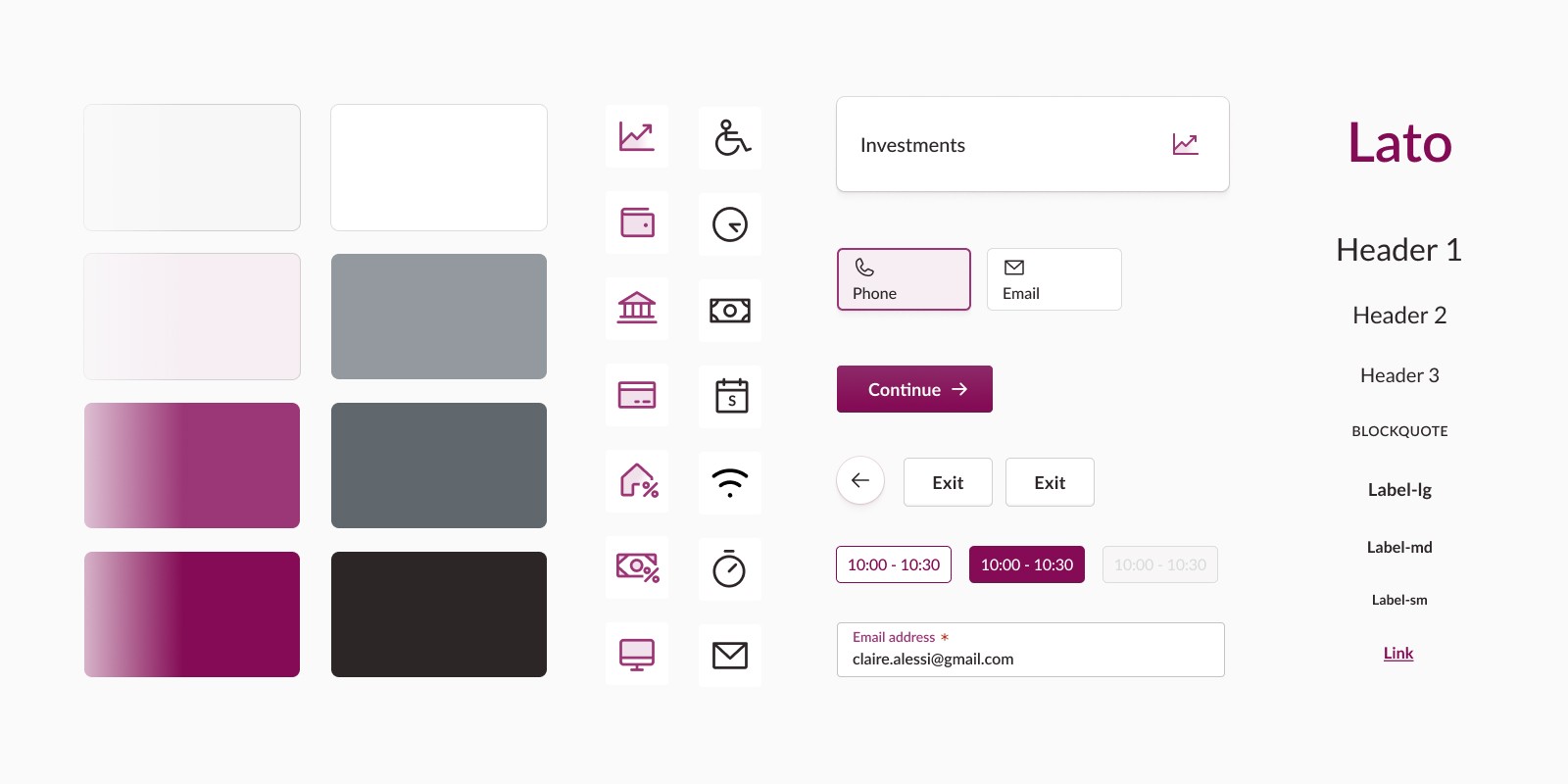

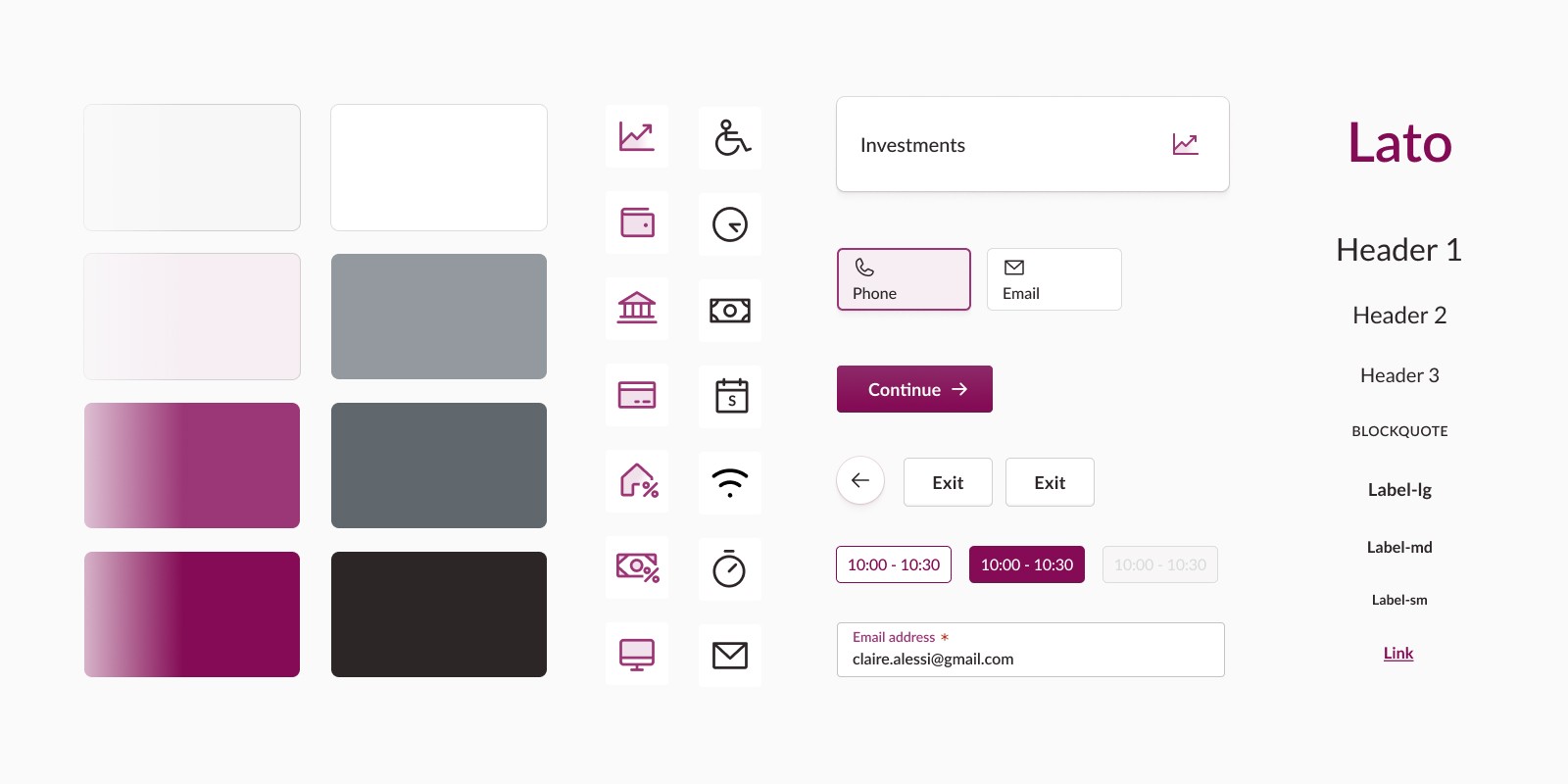

Glimpse the UI kit

Implementation

The appointment booking system's implementation was delayed for a few months due to the need for approval from the bank's newly appointed leadership.

If I had the chance...

Understand behaviours and opinions

I would conduct post-implementation testing to measure the experience. In order to understand satisfaction (but this could be biased) Satisfaction score.

In order to eliminate the bias, I would track also behavioural metrics such as Adoption rate – the number of customers who use the appointment booking system.

I would monitor the following numbers:

Hrs spent by bank employees working on booking appointments (the goal is to be reduced by 50%)

% of applications containing error

🙏 Thank you for reading till the end!

We were approached by Bank of Valletta, the largest bank in Malta, to create a new and improved appointment booking solution as their current one was outdated and incomplete.

The problem

Bank of Valletta receives 100-150 booking requests daily. However, the current system is inefficient, labor-intensive, and prone to human errors. Moreover, the few customers who use the existing system express dissatisfaction with it.

The goal

Develop end-to-end streamlined the booking process to reduce bank employee's workload connected booking by at least 50%

Introduce automation to reduce internal labor, manual tasks, and possible human errors. (back-end)

Reduce bank customers' inconvenience, such as making phone calls or visiting a branch to modify appointments

Build a system that assists customers in finding bank branches that offer the specific banking services they need

Discovery & Definition

Understanding the industry, process, and the difficulties faced by both BoV and its customers

We started with a workshop involving stakeholders, during which we collaboratively filled out a canvas to outline the business objectives, identify additional stakeholders, determine the best outcome we could achieve, and identify any potential risks.

To gain a deeper understanding, we have taken the following steps:

Developed a flowchart of the current solution to pinpoint shortcomings and friction.

Conducted stakeholder interviews.

Conducted user interviews (Bank branch employee, Virtual branch employee, and two bank clients).

Developed 4 archetypes with their goals and pain points based on the most frequent users of the app.

Analyzed available quantitative data and customer feedback from support and social media channels.

Conducted industry research to identify well-established patterns.

Learnings

Virtual branch employee interview:

It's hard to manage numerous appointments daily on top of the other services the Virtual branch provides while maintaining high customer satisfaction levels with efficient speed.

Customers frequently schedule an appointment at a branch where their documents are unavailable.

Bank branch employee interview:

Many clients inquire about the branch's operating hours after 5:00 PM to see if they can visit it after work.

Having trouble booking appointments in the shared diary because some of my colleagues forget to close it, which leaves it locked.

Has low confidence in technology.

Bank customers interviews:

The current system does not effectively communicate what to expect in the following steps.

The current system fails to build trust in new customers.

The current system requests unnecessary information, causing customer frustration and slowing the completion process.

During our industry analysis, we discovered the proven best practices

Materialize

With the knowledge acquired, we formed a hypothesis on how to solve these challenges and started iterating toward the final solution.

Drawing from the insights gained during the Discovery phase, the engineering part of the team provided recommendations for addressing the issues with appropriate technological solutions. I will focus on the design part in the following lines.

Depending on the service selected in the previous step, we list only the branches that offer this service. This way, we eliminate the option to book an appointment in a Branch which doesn't provide the service. Additionally, the user can quickly filter the branch list to show, for example, only ones that work past 17:00.

Once a booking is made, the system sends a confirmation email followed by a friendly reminder email the day prior to the scheduled appointment.

No more need to call the branch to reschedule your appointment

With the self-editing feature, customers have complete control over their bookings, eliminating the need for any interference from the bank and drastically reducing the risk of errors in the back office.

Glimpse the UI kit

Implementation

The appointment booking system's implementation was delayed for a few months due to the need for approval from the bank's newly appointed leadership.

If I had the chance...

Understand behaviours and opinions

I would conduct post-implementation testing to measure the experience. In order to understand satisfaction (but this could be biased) Satisfaction score.

In order to eliminate the bias, I would track also behavioural metrics such as Adoption rate – the number of customers who use the appointment booking system.

I would monitor the following numbers:

Hrs spent by bank employees working on booking appointments (the goal is to be reduced by 50%)

% of applications containing error

🙏 Thank you for reading till the end!

We were approached by Bank of Valletta, the largest bank in Malta, to create a new and improved appointment booking solution as their current one was outdated and incomplete.

The problem

Bank of Valletta receives 100-150 booking requests daily. However, the current system is inefficient, labor-intensive, and prone to human errors. Moreover, the few customers who use the existing system express dissatisfaction with it.

The goal

Develop end-to-end streamlined the booking process to reduce bank employee's workload connected booking by at least 50%

Introduce automation to reduce internal labor, manual tasks, and possible human errors. (back-end)

Reduce bank customers' inconvenience, such as making phone calls or visiting a branch to modify appointments

Build a system that assists customers in finding bank branches that offer the specific banking services they need

Discovery & Definition

Understanding the industry, process, and the difficulties faced by both BoV and its customers

We started with a workshop involving stakeholders, during which we collaboratively filled out a canvas to outline the business objectives, identify additional stakeholders, determine the best outcome we could achieve, and identify any potential risks.

To gain a deeper understanding, we have taken the following steps:

Developed a flowchart of the current solution to pinpoint shortcomings and friction.

Conducted stakeholder interviews.

Conducted user interviews (Bank branch employee, Virtual branch employee, and two bank clients).

Developed 4 archetypes with their goals and pain points based on the most frequent users of the app.

Analyzed available quantitative data and customer feedback from support and social media channels.

Conducted industry research to identify well-established patterns.

Learnings

Virtual branch employee interview:

It's hard to manage numerous appointments daily on top of the other services the Virtual branch provides while maintaining high customer satisfaction levels with efficient speed.

Customers frequently schedule an appointment at a branch where their documents are unavailable.

Bank branch employee interview:

Many clients inquire about the branch's operating hours after 5:00 PM to see if they can visit it after work.

Having trouble booking appointments in the shared diary because some of my colleagues forget to close it, which leaves it locked.

Has low confidence in technology.

Bank customers interviews:

The current system does not effectively communicate what to expect in the following steps.

The current system fails to build trust in new customers.

The current system requests unnecessary information, causing customer frustration and slowing the completion process.

During our industry analysis, we discovered the proven best practices

Materialize

With the knowledge acquired, we formed a hypothesis on how to solve these challenges and started iterating toward the final solution.

Drawing from the insights gained during the Discovery phase, the engineering part of the team provided recommendations for addressing the issues with appropriate technological solutions. I will focus on the design part in the following lines.

Depending on the service selected in the previous step, we list only the branches that offer this service. This way, we eliminate the option to book an appointment in a Branch which doesn't provide the service. Additionally, the user can quickly filter the branch list to show, for example, only ones that work past 17:00.

Once a booking is made, the system sends a confirmation email followed by a friendly reminder email the day prior to the scheduled appointment.

No more need to call the branch to reschedule your appointment

With the self-editing feature, customers have complete control over their bookings, eliminating the need for any interference from the bank and drastically reducing the risk of errors in the back office.

Glimpse the UI kit

Implementation

The appointment booking system's implementation was delayed for a few months due to the need for approval from the bank's newly appointed leadership.

If I had the chance...

Understand behaviours and opinions

I would conduct post-implementation testing to measure the experience. In order to understand satisfaction (but this could be biased) Satisfaction score.

In order to eliminate the bias, I would track also behavioural metrics such as Adoption rate – the number of customers who use the appointment booking system.

I would monitor the following numbers:

Hrs spent by bank employees working on booking appointments (the goal is to be reduced by 50%)

% of applications containing error

🙏 Thank you for reading till the end!